FOMO is a hell of a drug

The most dangerous feeling in finance is “fear of missing out”(FOMO). FOMO causes people to make hasty emotional decisions, generally near to the top of a speculative mania. FOMO is the force behind ponzi schemes, stock promotions, and simple legit bubbles. The Stanford Business School has even looked into this

The danger of FOMO impacts people regardless of socieoeconomic status or education. It even impacted Isaac Newton:

Source: the Vantage, (which has some excellent personal finance tips on avoiding the dangers of FOMO)

Last week things got a bit volatile. Markets corrected all the way to… (wait for it) the price level of a couple months ago. This was the result of a sudden sharp reversal of record retail inflows. Although it wasn’t really an abnormal reversal, the media made it sounded like the beginning of another financial crisis.

Day trading in the volatility complex is popular. Some people were getting rich, at least temporarily, by making highly levered bets on continued calm in financial markets. But for people who got in late, it ended badly. I doubt most investors in volatility products understand the risks Historically what happened this past week isn’t really abnormal. Volatility is normal in financial markets. (for an excellent explanation of the XIV debacle, see this article ).

Where are we in the cycle? I don’t know and I don’t care that much. I’m responsible for building wealth over the next few decades regardless of the vicissitudes of the broader market. I guess building up a retirement stash would be easier if I could dollar cost average into great businesses at absurdly cheap prices for several years. The founder at my employer loves to tell stories of the 70s bear market, which was preceded by the “go-go growth bull market in the 1960s. Once the bull market ended, stocks reversed sharply, kept going down often to absurd levels. He came into a small boost in investable cash right as the bear market started. He gradually took significant stakes in microcaps during several years of pain. Then he ended up getting rich in the 80s. I wouldn’t mind the opportunity to do the same, although it would be difficult from an emotional and career perspective for a few years.

Anyways, markets tend to top after a flood of people enter due to FOMO, rather than true understanding of what they’re buying. Prices collapse once there isn’t a greater fool to sell to.

Jeremy Grantham’s recent letter discussed valluation metrics and other characteristics of asset price bubbles:

In looking for signs of late bubble behavior, we have to reconcile to the fact that no two bubbles, even the classics, are the same. They share the fact that there are many signs of investor euphoria, sometimes indeed approaching the madness of crowds, but the package of psychological and technical indicators has been different each time.

Grantham noted that although valuation metrics are high, euphoria isn’t quite as extreme as he has seen in the past.

Anyone around in 1999 and early 2000 has had a classic primer in these signs. We know we’re not there yet, but we can perhaps see some early movement: increasing vindictiveness to the bears for costing investors money; the crazy Bitcoins of the world (this is a true, crazy mini-bubble of its own I expect – it has certainly passed my “nephew test” of his obsessing about buying or not); and Amazon and the other handful of current heroes – here and globally – taking over more of the press coverage and a growing percentage of total market gains (Amazon +13%, the day before I started to write this, and Tencent doubling this year to a $500 billion market cap). The increasingly optimistic tone of press and TV coverage is also important. A mere six months ago, new market highs were hardly mentioned and learned bears were featured everywhere. Now, the newspaper and TV coverage is considerably more interested in market events. (This last comment reminds me of some advice for contrarians: There is usually a phase or two in each cycle where most investors expect a market gain or loss and it actually happens. The mass of investors usually ends up wrong in the end, but not all the time, for Heaven’s sake!)

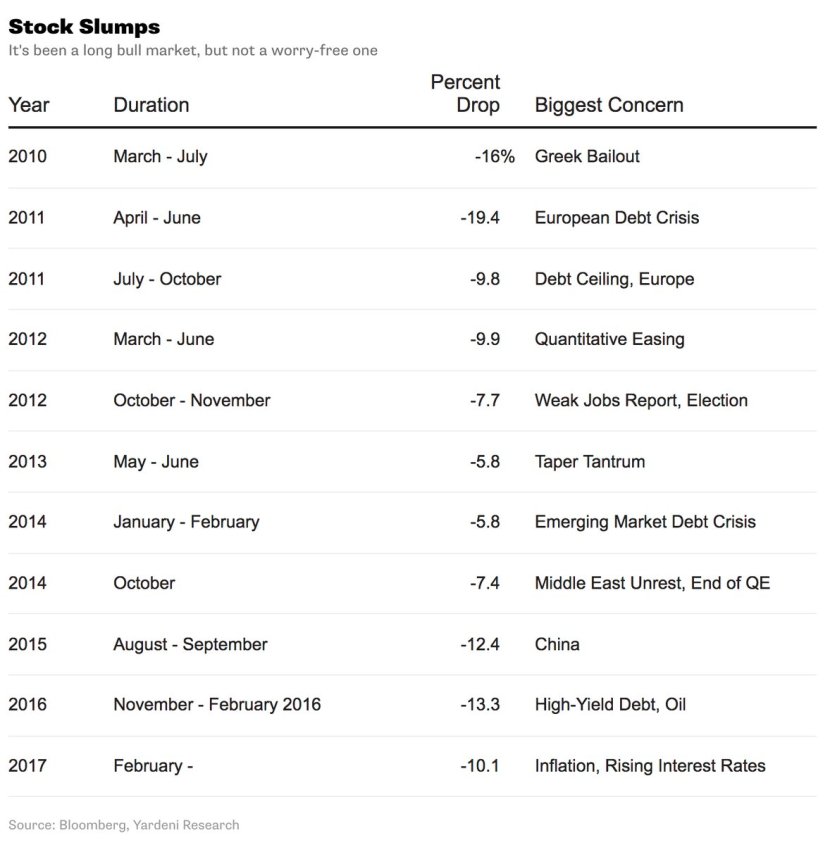

I can’t help but notice several euphoria indicators have been accelerating. Here are a collection of eerie warning signs indicating that we probably aren’t at a market bottom.

Things you don’t see at Market Bottoms

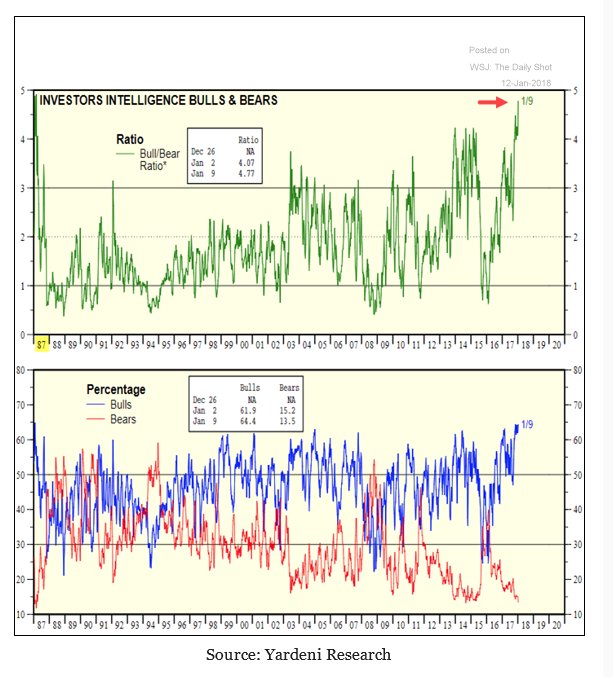

Extreme Investor bullishness

Investor’s entered 2018 with near record optimism:

Investor optimism in this market has reached new heights following a year of serious growth,” commented Mike Loewengart, VP of Investment Strategy at E*TRADE Financial. “While there are more than a few uncertainties to keep investors awake at night, they are clearly reacting to the roundly positive economic data that has been coming in at a steady stream, not to mention the boost that tax reform may bring. And as we approach our first earnings season of the year, investors are eyeing a variety of opportunities across the market.

That E-Trade Advertisement Indicator

E-Trade is blatantly trying to capitalize on FOMO. For example, “the dumbest kid in high school just got a boat…” “Don’t get mad, get E-Trade”

Here are a couple ads from the dot com bubble:

Joseph Kennedy reputedly sold out of stocks and went short right before the great depression based on the fact that his shoeshine boy started giving out stock advice. I’m hesitant to use the “shoeshine boy indicator” because I truly believe basically anyone should be able to build a decent retirement through decades of careful saving and prudent investing. The problem is the get rich quick mentality that leads to the extreme bubbles. You don’t see people with no interest in business suddenly pursuing riches in the stock market at market bottoms.

That Cramer article indicator

February 2000 (one months before the .com bubble top) : Winners of the New World

January 2018: ‘This time it’s different’ is no longer risky

These articles aren’t completely wrong- industries often do experience secular change- but they demonstrate a level of arrogance and not typically seen at market bottoms.

Confirmation bias and the XFL

The XFL is coming back. It was first founded in 1999, and played only one inaugural season(2001). Its founding effectively coincided with the top of the tech bubble. This has nothing to do with market valuation, and the fact that I noticed it is probably just confirmation bias.