Category: Books

Empty Spaces on Maps

Prior to the 15th century, maps generally contained no empty spaces. Mapmakers simply left out unfamiliar areas, or filled them with imaginary monsters and wonders. This practice changed in Europe as the great age of exploration began. In Sapiens, Yuval Harari argues that leaving empty spaces on maps reflected a more scientific mindset, and was a key reason that Europeans were able to conquer and colonize other continents, in spite of starting with a technological and military disadvantage. Conquerors were curious, but the conquered were uninterested in the unknown. Amerigo Vespucci, after whom our home continent was named, was a strong advocate of leaving unknown spaces on maps blank. Explorers used these maps to move beyond the known, sailing into those empty spaces so they did not stay unmapped for long.

The same phenomenon occurs in business. In the Innovator’s Dilemma, Clayton Christensen shows why large established ostensibly well-run companies so frequently miss out on major waves of innovation. A key principle in the book is the difference between sustaining technologies, which merely improve the status quo, and disruptive technologies, which offer a new and unique value proposition. Large companies will frequently focus on sustaining technologies, and ignore disruptive technologies that serve fringe markets initially. Ultimately its disruptive technologies that define business history. Yet complacent companies don’t figure that out until its too late.

Companies whose investment processes demand quantification of market sizes and financial returns before they can enter a market get paralyzed or make serious mistakes when faced with disruptive technologies.

There are two parts to overcoming the innovator’s dilemma:

- Acknowledging that the market sizes and potential financial returns of a nascent market are unknowable and cannot be quantified (drawing the blank spaces on the maps) and;

- Entering the nascent market in the absence of quantifiable data- (travelling into the empty space)

Analogous ideas also apply to investing. In Investing in the Unknown and Unknowable, Richard Zeckhauser distinguishes between situations where the probability of future states is known, and when it is not. The former is the realm of academic finance and decision theory. The latter is the real world.

The real world of investing often ratchets the level of non-knowledge into still another dimension, where even the identity and nature of possible future states are not known. This is the world of ignorance. In it, there is no way that one can sensibly assign probabilities to the unknown states of the world. Just as traditional finance theory hits the wall when it encounters uncertainty, modern decision theory hits the wall when addressing the world of ignorance.

Human bias leads us into classic decision traps when confronted with the unknown and unknowable. Overconfidence and recollection bias are especially pernicious. Yet just because we are ignorant doesn’t mean we need to be nihilists. The essay has some key optimistic conclusions:

The first positive conclusion is that unknowable situations have been and will be associated with remarkably powerful investment returns. The second positive conclusion is that there are systematic ways to think about unknowable situations. If these ways are followed, they can provide a path to extraordinary expected investment returns. To be sure, some substantial losses are inevitable, and some will be blameworthy after the fact. But the net expected results, even after allowing for risk aversion, will be strongly positive.

Examples in the essay include David Ricardo buying British Sovereign bonds on the eve Battle of Waterloo, venture capital, frontier markets with high political risk, and some of Warren Buffet’s more non-standard insurance deals. Yet since even the industries that seem simple and steady can be disrupted, its critical to keep these ideas in mind at all times in order to avoid value traps.

The best returns are available to those willing to acknowledge ignorance, then systematically venture into blank spaces on maps and in markets.

Investing in the Unknown and Unknowable

See also:

Infinite Detail: With Zero Bandwith, Things Get Weird

What would happen if the internet crashed everywhere- completely died, and didn’t come back? Tim Maughan’s Infinite Detail is a dystopian sci fi novel that hits close to home.

The book alternates between Before and After chapters, slowly revealing details on the great crash that destroyed the global internet infrastructure. There is also an ongoing long distance love story interrupted by the great crash.

The Before chapters are a slightly more advanced version of our current reality. Everything is connected and everything is tracked. People accept lack of privacy in exchange for extreme convenience. Almost everyone uses “Spex” which are glasses that allow people to access information just by moving your eyes- a step more convenient than a smartphone . Cities are all “smart” with services such as trash collection automated.

The book explores how the underclass is impacted by smart cities. Relying on RFID tags for recycling means people who collect cans to survive(canners) are subject to problems caused by technology. The city is full of canners:

There’s hundreds of us. Thousands, maybe. City is full of ’em. Used to be a lot of people did it as a part-time thing, but more and more are going full-time, it seems. Especially since there’s no work for cabbies now, y’know? I used to know a lot of cabbies that would just do a little canning on the side when work was slow and all, but now they gotta go full-time, they says. Say nobody wants anyone to drive a cab anymore. I ain’t worried, though.

The attitude of one superstar canner is eerily reminiscent of people who fail to keep up with changes in the digital economy:

“Hell yeah! Canning is a growth industry. I been doing this fifteen years, and every year I seen more cans than before. There’s always going to be canning, as long as there’s people that want to drink. They’ll never stop that. Never take that away from me. They might not need cab drivers anymore, but they’ll always need canners.” He smiles, for the first time. Rush isn’t sure what to say to him. He sighs and looks at the cart, and the hundreds of floating tags reappear. His heart sinks.

A group of disillusioned techno optimists are they key characters in the Before scenes. Their views are basically a more extreme version of current critics driving the anti Silicon Valley backlash. Many of them started out as idealists who believed in the internet, but became cynical as corporations and governments started using it for control.

We used to think that we could own it, that we were fighting to build communities for ourselves. That it was ours for the taking. To stake a claim for a place we could control and belong, a fight to make “safe spaces” for ourselves.It was a noble thing to think, that we were fighting for our own spaces, but we were kidding ourselves. We never owned these spaces, we never could. They were never ours to own, never ours to control. Instead we watch our battles turn into spectator sports, our revolutions turn to infighting. We watched our new communities dissolve into civil wars. We watched our political activist and community leaders become celebrity brands, our tech-utopian visionaries bow to capital and shareholders

A group of them builds an experimental community completely cut off from global networks. A terrorist group combines hacking with real life terrorism. Their motto is “With zero bandwidth there is no calling for backup.”

Rumors spread that someone is developing a virus that can impact all internet connected devices. When its released, people experience:

a very real sense that something had ended, had gone, something huge and fundamental. The feeling that a structure — a way of life, something nobody could really imagine changing — had collapsed. The end of being watched. The end of being tracked. The end of being indentured to it all. The end of capital. The end of security. The end of knowing. The end of safety. The end of being reassured. The end of being connected. The end of friendships. It was all there, in that crowd, sprayed across faces that had been denied sleep and electricity and communication for days — the fear, the uncertainty, the excitement, the thrill. The relief.

The After chapters describe a post apocalyptic hellscape where people struggle for survival. Chaos breaks out across the world as every city simultaneously goes dark. The descriptions are fantastic

…video games industry conference in Los Angeles that had to be abandoned and had quickly dissolved into spoiled man-children rioting; an automated container terminal in Shanghai that shut itself down for nearly a week and caused the collapse of at least two shipping companies; and countless other blackouts and disruptive infrastructure failures. He’d also seen it connected to protests—the Times Square blackout being just the latest, after an uprising of migrant workers in Singapore, and the takeover of a brand-new, built-from-scratch, concept-art-perfect smart city by an army of protesters from the slums of Mumbai.

As is often the case, utopian revolutionaries are dismayed at what happens in real life, once they actually “win”. Civil wars occur around the globe. The former unconnected haven ends up turning into a scene of bloody conflict between the old guard government, and a group of outlaws. Basically everything is worse than it was before.

As one character puts it:

Your self-determination is a fucking power vacuum, that’s all it is. Your revolution, with no idea of what would happen next, just created a massive hole full of people fucking each other over to stay alive.

The impact on people’s material well being is most stark.

She finds herself heading down the steps of a long-motionless escalator to the floor below, eager to explore, drawn to join in, wanting to experience what appears to be the decentralized, community-driven anarchic economy they’d spent so many late, stoned, enthusiasm-soaked nights dreaming of…

Instead, standing in the silence of the first shop she passes, she finds inevitable disappointment. For a start, the nameless store has barely any stock, and what is here is a disorganized mess of broken, discarded junk piled up in boxes or spread randomly around the half-bare shelving—at first glance she thinks it could even be the ramshackle debris left over from the original store’s ransacking, but soon she realizes the truth is even more depressing. For that to be true there’d have to be some shred of purpose, form. Between embarrassed glances she starts to think that maybe it’s just her own deep-rooted, bred-in consumer expectations clouding her assessment, so she tries to throw them aside and embrace the nonconforming landfill-mined chaos of scuffed plasticwear, broken crockery, torn clothing, dead electronics, and crumbling paperbacks—but it’s impossible. There’s not just a lack of organization here, it’s a total absence of function, value.

People who had acquired a cargo ship ahead of the crash go on a tour of the world, and observe collapsed cities, and silent ports. Its an interesting commentary on global supply chains. They make everything so convenient, but are really quite fragile.

This was why the supply chains existed, in order to make transactions that logic dictated were most efficient on local scales work on global ones, through sheer size, brute force, cheap labor, and global inequality.

…pinnacle of human effort had been to create a largely hidden, superefficient, globe-spanning infrastructure of vast ships and city-size container ports—and all to do nothing more than keep feeding capitalism’s hunger for the disposable. To move plastic trash made by the global poor into the hands of hapless, clueless consumers. A seemingly unstoppable beast built from parasitic tentacles, clenching the planet with an iron grip.

The crash has an irreversible impact on relationships, especially those that are long distance:

He sits there for a minute, in silence. It’s the first time they’ve been forcibly disconnected like this, and it’s jarring. Like they’ve been ripped apart, like he’s lost control. Suddenly the frailty of their relationship feels exposed, like it’s utterly reliant on this vast global infrastructure that he doesn’t own or control, that’s too complex for any one person to understand, that could break or disappear without even a second’s notice. He could lose him completely, just at the flick of a switch, at the typing of a command.

Why all great investors are intellectual cross dressers

A recurring motif in Capital Returns: Investing Through the Capital Cycle, by Edward Chancellor is that growth vs. value is a false dichotomy:

Our belief is that stocks should be viewed not as “growth” or “value” opportunities, but rather from the perspective of whether the market is efficiently valuing their future earning prospects.

…

Marathon’s approach is to look for investment opportunities among both value and growth stocks, as conventionally defined. They come about because the market frequently mistakes the pace at which profitability reverts to the mean. For a “value” stock, the bet is that profits will rebound more quickly than is expected and for a “growth stock,” that profits will remain elevated for longer than market expectations.

…

Marathon looks to invest in two phases of an industry’s capital cycle. From what is misleadingly labelled the “growth” universe, we search for businesses whose high returns are believed to be more sustainable than most investors expect. Here, the good company manages to resist becoming a mediocre one.From the low return, or “value” universe, our aim is to find companies whose improvement potential is generally underestimated. In both cases, the rate at which a company reverts to mediocrity (or “fade rate”) is often miscalculated by stock market participants. Marathon’s own experience suggests that the resultant mispricing is often systematic for behavioural reasons.

…

Labelling fund managers as “value” or “growth investors risks distorting the investment process

Warren Buffett discussed a similar idea in Berkshire Hathaway’s 1997 Shareholder letter:

…most analysts feel they must choose between two approaches customarily thought to be in opposition: “value” and “growth.” Indeed, many investment professionals see any mixing of the two terms as a form of intellectual cross- dressing.

We view that as fuzzy thinking (in which, it must be confessed, I myself engaged some years ago). In our opinion, the two approaches are joined at the hip: Growth is always a component in the calculation of value, constituting a variable whose importance can range from negligible to enormous and whose impact can be negative as well as positive.

In addition, we think the very term “value investing” is redundant. What is “investing” if it is not the act of seeking value at least sufficient to justify the amount paid? Consciously paying more for a stock than its calculated value – in the hope that it can soon be sold for a still-higher price – should be labeled speculation (which is neither illegal, immoral nor – in our view – financially fattening).Whether appropriate or not, the term “value investing” is widely used. Typically, it connotes the purchase of stocks having attributes such as a low ratio of price to book value, a low price-earnings ratio, or a high dividend yield. Unfortunately, such characteristics, even if they appear in combination, are far from determinative as to whether an investor is indeed buying something for what it is worth and is therefore truly operating on the principle of obtaining value in his investments. Correspondingly, opposite characteristics – a high ratio of price to book value, a high price-earnings ratio, and a low dividend yield – are in no way inconsistent with a “value” purchase.

Similarly, business growth, per se, tells us little about value. It’s true that growth often has a positive impact on value, sometimes one of spectacular proportions. But such an effect is far from certain….

…Growth benefits investors only when the business in point can invest at incremental returns that are enticing – in other words, only when each dollar used to finance the growth creates over a dollar of long-term market value. In the case of a low-return business requiring incremental funds, growth hurts the investor.

Berkshire Hathaway’s 1997 Shareholder letter

False dichotomy, but useful heuristic

Growth vs. value is a false dichotomy, but it might be a useful heuristic for organizing a portfolio. With a “value” investment, you are buying assets, and betting on a reversion to the mean. Generally this means other people are overestimating the bleakness of the future. With a “growth” investment you are buying the future business, betting on change. Generally this means other people are underestimating the brightness of the future.

The key is having an intellectually honest variant view.

Venture capital and value investing

In a similar vein, its easy to see how venture capital and value investing are actually quite similar. Both are mispriced bets on the probability of change.

Tren Griffin wrote about this:

Venture capital and value investing share many different elements but each system is based on a different mispricing. This is a critically important point for an investor to understand. If an asset is not mispriced, market outperformance is not mathematically possible. It is also important to understand that investments can be mispriced for different reasons.

In venture capital the mispricing occurs because very few investors or asset owners understand optionality. This allows a VC to buy what are essentially long-dated, deeply-out-of-the-money call options from companies at prices which are a bargain.…

In value investing the mispricing occurs because the market is bipolar (i.e., neither always rational nor always efficient). This allows an investor to sometimes buy assets at a price which reflects a discount to intrinsic value (i.e., a bargain) and to wait for a good result rather than trying to “time” the market.

The fundamental difference between venture capital and value investing

Marc Andreessen, in an interview with Tim Ferriss, expressed a similar idea, noting how much he studies and admires Warren Buffett:

Business Lessons From Marc Andreeseen

… every time I hear a story like See’s Candies, I want to go find the new scientific superfood candy company that’s going to blow them right out of the water. We’re wired completely opposite in that sense. Basically, he’s betting against change. We’re betting for change. When he makes a mistake, it’s because something changes that he didn’t expect. When we make a mistake, it’s because something doesn’t change that we thought would. We could not be more different in that way. But what both schools have in common is an orientation toward, I would say, original thinking in really being able to view things as they are as opposed to what everybody says about them, or the way they’re believed to be.”

A decent portfolio has a combination of mean reversion bets, and underpriced deep out of the money options. It pays to be an intellectual cross dresser

Aggregators by any other name

In the past I have been a knee jerk advocate of disintermediation. However upon closer examination I realized that the reality of middlemen is far more nuanced. Many people believe that modern technology is eliminating middleman, yet in fact their role is changing shape, not disappearing. In the Middleman Economy , Marina Krakovsky examines this aspect of the modern economy. The Private Investment Brief has also produced valuable analyses of middleman business models. Additionally, Michael Munger’s paper puts this all into a historical context with emphasis on the importance of reduced transaction costs.

Conventional wisdom says that middleman take a cut of every deal, so they raise buyer costs and reduce seller profits. In reality by facilitating transactions that would otherwise not happen at all, good middlemen enlarge the size of the pie, making all parties better off. Many people assume that middlemen’s work is easy because they don’t actually create anything. But to create value… good middlemen must cultivate distinct skills and practices, which they deploy in work that until now has been largely hidden from public view…“Instead of the of the demise of the middlemen, we are seeing the rise of the middleman. In fact , ours is more than ever a middleman economy.”

Marina Krakovsky, Middleman Economy

There seems to be a gap between public perception and market reality. Therein lies the opportunity:

And yet—thousands of years after it first occurred to someone to ask “why don’t they just cut out the middleman?”—middlemen continue to exist and even thrive. Therein lies the opportunity, for if we can learn to appreciate what others dismiss or misunderstand, we might then have an investing green field all to ourselves

-Mystery of the Middleman

Indeed, Michael Munger takes it even further and argues that we are experiencing a profound historical shift that will alter capital allocation incentives across the economy:

The Neolithic revolution made it possible for humans to enter complex relations of more or less voluntary dependence, and to share economies of organization and information. The Industrial revolution created an astonishing burst of productivity, which made ownership of

Michael Munger: The Third Entrepreneurial Revolution: A Middleman Economy

a bewildering variety of commodities and tools possible for all but the poorest of people, where just 50 years before such items would have denied all but wealthiest. The Middleman revolution, the third revolution whose leading edges we are now crossing, will transform owning

into sharing. The Middleman revolution will make it possible, for the first time, for entrepreneurs to create value almost exclusively by reducing the transactions costs of sharing existing commodities, or by sharing commodities or services made expressly to be shared by the new platforms and new market processes.

Aggregators by any other name

In a world where buyers and sellers can just find each other online quickly and easily, middleman must be obsolete, right?

…

Wait a minute…

Often when people talk about cutting out the middleman, they are actually just replacing it with a new middleman. All the aggregator platforms are in fact distinct breeds of middlemen whose businesses are made possible by the internet. Examples include: Airbnb, Lyft and Uber, Taskrabbit, Grubhub, ZocDoc, etc. Instead of a person, buyers and sellers deal with software on a website that is developed and managed by people. As Krakovsky points out:

In many ways, the internet is a middleman’s ally. Thanks to the internet, middlemen who used to do business in person — a position that limited their geographic reach can a attract customers from all over and can share information with them more quickly and easier than ever…

…

These days, two sided markets (sometimes called two-sided networks or two sided platforms ) are everywhere because many of today’s internet startups are middlemen business of exactly this type

See also:

Aggregation Theory Stratechery

Aggregator Economics-Private Investment Brief

Modern Monopolies

Multidisciplinary thinking

Understanding middleman requires multidisciplinary thinking. There isn’t really one accepted definition, and there are many different angles from which to analyze how this social and economic phenomenon works:

Economic theory has much to say about transaction-cost economics, two sided markets, and intermediaries ability to reduce information asymmetries between buyers and sellers. In particular, game theory informs our understanding of repeated interactions, reputation, shirking and cheating, and third party enforcement. Social psychology and experimental economics show how acting on behalf of others affect people’s behavior and impressions. And sociology offers insights into the way acting on behalf of others affects people’s behavior and impressions. And sociology offers insights into the ways the structures of social networks create opportunities for middlemen

Six kinds of Middlemen

Krakovsky identifies five different roles that middleman can play. These roles define what middleman’s trading partners expect, so its critical for a middleman to know what role they play, and do play it well. They often overlap, so a successful business may fill of these roles at different times in the same supply chain.

Bridge

A bridge promotes trade by reducing distance(either physical, social or temporal). RA Radford’s study on the development of a market in a WWII POW camp is a stark example. An itinerant priest was willing to connect disparate groups who did not interact, facilitating trade along the way.

Another example featured in the New York Times and highlighted by Private Investment Brief involves an Afghanistan based used clothing wholesaler who makes an annual trip to Pakistan to buy bulk clothing. He is able to succeed for many reason, one of which is the fact that he reduces the fixed costs of dealing with travel, customs, logistics, etc.

Certifier

A certifier gives reassurance about underlying quality. This is important anywhere there is need for a trusted third party. Essentially, they help fix information asymmetry in a market. That same clothing wholesaler who facilitated trade between Pakistan and Afghanistan was also known as a trusted counter party to disparate group of buyers and sellers.

Trust is an elusive and intangible quality, so those of us in the more contemplative, analytical corners of the business world tend to underestimate how important it is to people transacting day to day

Mystery of Middlemen

Enforcer

An enforcer makes buyers and sellers cooperate and stay honest. Like certifiers, they are important in situations where there is need for a trusted third party. My favorite example of an enforcer is the role of a pimp at a truck stop in Uganda.

Risk Bearer

A risk bearer reduces fluctuations. Micro VCs play this role, especially now that technology has drastically reduced the cost of starting businesses. “Uber for this or that” business models are an example of a risk bearer business model. Additionally in the Japanese fish markets, risk bearing middleman ensure smooth functioning of trade in a highly perishable commodity.

Concierge

A concierge reduces hassles and helps clients deal with information overload. For example, travel agents, in spite of widespread predictions of their demise, play a critical role in high end business travel as concierge middlemen.

Insulator

An insulator helps clients get what they want without being though of as too greedy, self promotional, or confrontational. Sports agents help defuse tensions between players and teams. Additionally, sometimes an investor will use a broker to build up a position without signalling the market. This may be essential in distressed and illiquid securities, or disputed situations.

Transaction costs

Munger looks at markets in the broad sweep of history. The role of technology, he argues, is in creating a new “entrepreneurial revolution” that makes middleman more important in an an economy based on sharing, not owning.

The third entrepreneurial revolution will be based on innovations that reduce transactions costs, not the costs of the products themselves. An unimaginable number and variety of transactions will be made possible by software platforms that make renting from a middleman, rather than renting from one’s self, cheaper.

A former student of Douglass North, Munger emphasizes the transaction cost angle throughout:

To succeed, a middleman has to reduce three key transactions costs:

• Provide information about options and prices in a way that is searchable, sortable, and immediate

• Outsource trust to assure safety and quality in a way that requires no investigation or

effort by the users

• Consummate the transaction in a way that is reliable, immediate, and does not require negotiation or enforcement on the part of the users

The ecological consequences of hedge fund extinction

Investing goes through fads. Investing strategies and fund structures(1) go in and out of style. Nowadays long/short hedge funds are out and infrastructure funds are in. Within the public equity markets, value is out, growth/momentum is in. Each time this happens, people forget how the cycle repeats.

In fact, one CIO contended that if he brought a hedge fund that paid him to invest to his board, the board would dismiss it without consideration — simply because it’s called a hedge fund, and hedge funds are bad.

Institutional Investor

Hedge funds may have to do a name change if they want to raise capital.

Remember last time?

And yet people forget:

Allocators woke up craving the next rising hedge fund star and couldn’t invest enough at high and increasing management fees after the widespread success of long-short funds in the weak equity markets of 2000-2002. Board rooms back then castigated CIOs for not having long-short equity hedge funds in their portfolios.

This isn’t the first time:

People forget that 40 years ago, officials such as Paul Volcker of the Federal reserve wanted an active hedge fund industry to absorb the risk that was not well managed by state-insured banks.

Financial Times

Each investment strategy picks up a certain type of risk(and potentially earns a profit in doing so)- if a strategy disappears that particular risk can become a systemic issue. Fortunately, around this time it also becomes more lucrative to bear the risk others are unwilling to bear. Eventually the risk reward tradeoff starts to make sense again.

Different, different, yet same

In the 1960’s Warren Buffett put up ridiculous returns, and Alfred Winslow Jones proteges profitably exploited anomalies in markets. By the mid 1970’s of there were many articles about hedge funds shutting down though. Industry AUM declined ~70% peak to trough. Nifty fifty boom and bust followed by the long nasty bear market. But as the institutional architecture of international trade and currency shifted we entered glory years of global macro/commodities traders. Then the 80’s were great for Graham deep value and Icahn style activist investing after the 70’s bear market left a huge portion of the market selling below liquidation value.

Likewise late 90’s again saw the death of hedge funds as day traders in pajamas earned easy returns from the latest dot-com- until the crash. Yet out of the rubble of the tech bubble rose a new generation of great hedge fund managers. There was rich pickings for surviving value hunters- and those with the guts and skills to execute became household names a few years later. Many value managers that nearly went out of business during the tech bubble put up ridiculous numbers 2000-2002 and through the next financial crisis. (See: The arb remains the same)

The greatly exaggerated death of a style gives rise to an environment where there is a plethora of opportunities for something similar to that style to work. Each time the narrative in the greater investment community favors some type of uniform strategy, and LPs give less capital to other strategies- causing them to nearly die off. But then the lack of people pursuing the out of fashion strategy makes its return potential more lucrative. Eventually someone finds a new method to pick up those dollar bills on the ground that shouldn’t exist.

Economics emphasizes rational actors and equilibrium. Yet the messy reality is far more complicated. Ecology is a far more useful mental model.

A giant self over-correcting ecosystem

There is in ecological function to speculative capital and over time there should be some excess returns to those willing to take mark-to-market losses

Financial Times

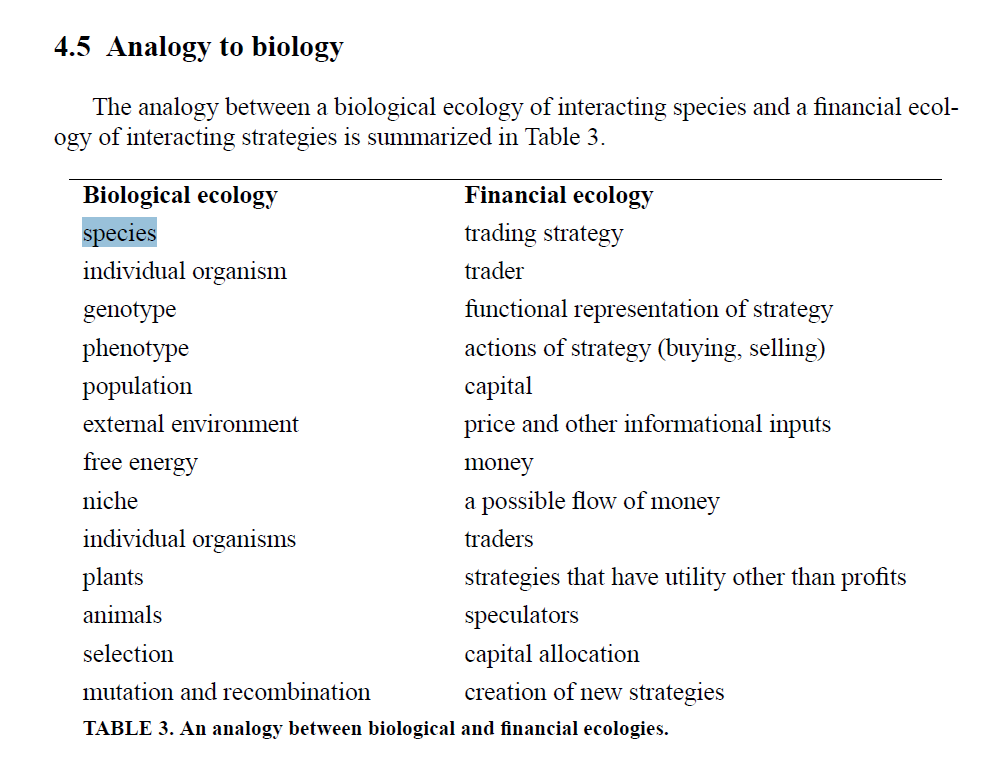

Like biological species, financial strategies can have competitive, symbiotic, or predator-prey relationships. The tendency of a market to become more efficient can be understood in terms of an evolutionary progression toward a richer and more complex set of financial strategies.

Market force, ecology and evolution

Ecology emphasizes interrrelationships between different individuals and groups within a changing environment, and indentifies second order impacts.

Thinking like a biologist

One can develop a useful framework by replacing species with strategy, population with capital, etc

Flows and valuation interact, self correct, and overshoot.

….capital varies as profits are reinvested, strategies change in popularity,and new strategies are discovered. Adjustments in capital alter the financial ecology and change its dynamics, causing the market to evolve. At any point in time there is a finite set of strategies that have positive capital; innovation occurs when new strategies acquire positive capital and enter this set. Market evolution is driven by capital allocation.

Market evolution occurs on a longer timescale than day-to-day price changes. There is feedback between the two timescales: The day-to-day dynamics determine profits, which affect capital allocations, which in turn alter the day-to-day dynamics. As the market evolves under static conditions it becomes more efficient. Strategies exploit profit-making opportunities and accumulate capital, which increases market impact and diminishes returns. The market learns to be more efficient.

Evolution

When an ecoystem is overpopulated with a certain species, it eventually overshoots and results in mass starvation. Populations fluctuate wildly across decades, and sometimes species go extinct or evolve into something that seems new.

New conditions give rise to new dominant species.

See also:

George Soros on disequilibrium analysis

The arb remains the same

Book:

Investing: The Last Liberal Art

Hedgehogging

More Money than God

(1) Although I am frequently pedantic about the differences between structure, strategy, and sector, many in the media seem to use these interchangeably when discussing reversion to mean situations. Fortunately they all exhibit the same boom/bust phenomenon, so I am using them interchangeably here.

Books I kind of liked in 2018

Non-Fiction

- Technological Revolutions and Financial Capital

- Capital Returns

- Modern Monopolies

- How the Music Got Free

- Laws of Human Nature

- Debt’s Dominion: A History of Bankruptcy Law in America

- Thinking in Bets: Making Smarter Decisions When You Don’t Have All the Facts

Fiction

Non-Fiction

Technological Revolutions and Financial Capital did more to advance my understanding of the modern economy than any other book I read in 2018. Traditional economics treats sudden changes of technology as a separate exogenous factor. This mode of thinking is pretty much useless for anyone forced to allocate capital under uncertain conditions. In reality there is strong empirical evidence that financial markets and technology interact in repeated cycles . Carlota Perez shows the pattern in these cycles by breaking them down into Installation and Deployment Phases. She identifies four main parts of each technological cycle: Irruption, Frenzy, Synergy and Maturity. The book illustrates these patterns in the most important disruptions in economic history, including: the industrial revolution , steam engines/railways, steel/electricity/heavy engineering, automobiles/mass production, and information/telecom. Marc Andreesen hailed Technological Revolutions and Financial Capital as the single best book for understanding the software industry. Since software is eating the world, its probably also the best book for understanding any industry.

Capital Returns is about how competitive advantages change over time, and how changes in capital availability can alter industry dynamics. It covers a fund manager’s thoughts and activities from 2002- 2015, including periods of disruption and volatility in a variety of industries. Ultimately the book is about how mean reversion occurs and and impacts investors.

Modern Monopolies deserves most of the hype that it has received. Many business decision makers were schooled in “linear” business models, but the most valuable and disruptive businesses are platforms, business model that facilitate the exchange of value between two or more user groups, a consumer and a producer. This book covers how technology has enabled more platform business models, and what the implications are for investors and entrepreneurs.

How the Music Got Free tells the story of how streaming music and piracy upended the music industry. It also covers the story of how the MP3 format struggled to gain acceptance for many years before becoming ubiquitous. The contrasting attitudes and actions of the winners and losers in the story are an entertaining juxtaposition , and a useful case study. As a teenager I had been one of the early pirates, but was less aware of what was going on inside the old line music companies, and had not zoomed out to consider the broader industry implications.

Laws of Human Nature is an essential guide for understanding how people act and how society functions. It teases out key lessons from psychology along with successes and failures throughout history. Reading one Robert Greene book provides a reader with the benefits of reading dozens of business biographies and history books. It provides ideas for avoiding certain problematic tendencies in oneself and exploiting traits in others. Laws of Human Nature looks at the dark reality of patterns in thought and behavior that don’t conform to an idealistic rational expectation:

As long as there are humans, the irrational will find its voices and means of spreading. Rationality is something to be acquired by individuals, not by mass movements or technological progress. Feeling superior and beyond it is a sure sign that the irrational is at work.

Debt’s Dominion: A History of Bankruptcy Law in America, is a bit wonkish, but well worth the slog for the insight into the American bankruptcy system. Its easier to understand the subtle nuances of the bankruptcy process and navigate opportunities in the distressed debt market when I think about how the system evolved. Indirectly the book is also about the slow process of institutional change.

Thinking in Bets is basically a long essay on behavioral economics, with one valuable message. Under a plethora of entertaining anecdotes about professional poker it provides an immediately applicable framework for functionning in an uncertain world. Basically its a slightly less nerdy and less nuanced companion to Fortune’s Formula. It also fits in well with some of the more important behavioral finance books, such as…. Misbehaving, and Hour Between Dog and Wolf, Kluge, etc. (more notes here)

Fiction

The Coffee Trader is historical fiction taking place in 17th century Amsterdam, when coffee was first brought to Europe and the modern concept of stock and derivative markets were just beginning to form. It tells the story from the vantage point of Miguel Lienzo, a small time speculator who must navigate complex social structures, and deal with shady counter parties and aggressive creditors and competitors while trying to get rich in a nascent market. He is also a Jewish refugee who fled the Portuguese inquisition but then struggles with overly conservative Jewish leaders in Amsterdam, who constantly threaten to shun him. Complicating matters further, he has a conflict with his brother, who is at the beginning a far more successful and respected member of the community.

The first person narration includes gems like this one:

There was no shortage of my kind in Amsterdam. We were as specialized as taverns, each of us serving one particular group or another: this lender serves artisans; that one, merchants; yet another, shopkeepers. I resolved never to lend to fellow Jews, for I did not want to travel down that path. I would not want to have to enforce my will on my countrymen and then have them speak of me as one who had turned against them. Instead, I lent to Dutchmen, and not just any Dutchmen. I found myself again and again lending to Dutchmen of the most unsavory variety: thieves and bandits, outlaws and renegades. I would not have chosen so vile a bunch, but a man has to earn his bread, and I had been thrust into this situation against my will.

Three Body Trilogy is a deep character study of humanity itself in the form of an epic science fiction story spanning multiple centuries. It ultimately focuses on the way people act in situations of duress and conflict, both within and between different countries and groups. The Three Body Problem starts slowly, opening during the Chinese Cultural revolution, and tells of the initial contact with alien civilizations. The Dark Forest explores the paradoxical alignment of incentives in high stakes inter galactic diplomacy. The ultimate conclusion for the future of civilization in Death’s End is pessimistic, but getting there is thrilling.

Pattern Recognition is a thriller set in the early 2000s that feels like a science fiction take on modern media. The protagonist is a branding consultant/corporate spook who gets sent on a mission to uncover the anonymous creator behind a series of video clips that have spawned an obsessive subculture of fans. She tracks people and clues down in London, Tokyo and Moscow meeting many bizarre and unseemly characters along the way.

As with all Gibson novels, the dialogue and descriptions are fantastic.

“Of course,” he says, “we have no idea, now, of who or what the inhabitants of our future might be. In that sense, we have no future. Not in the sense that our grandparents had a future, or thought they did. Fully imagined cultural futures were the luxury of another day, one in which ‘now’ was of some greater duration. For us, of course, things can change so abruptly, so violently, so profoundly, that futures like our grandparents’ have insufficient ‘now’ to stand on. We have no future because our present is too volatile.” He smiles, a version of Tom Cruise with too many teeth, and longer, but still very white. “We have only risk management. The spinning of the given moment’s scenarios. Pattern recognition.

Meta-Reading and the value of fiction

In 2018 I refined my reading habits in a manner that drastically improved my overall experience. I sought out more books with big ideas that had stood the test of time, and started more systematically filtering and skimming newer non fiction. I also started reading more fiction.

Nonfiction

I read the Financial Times and the Economist regularly, monitor key topics on Google News, and regularly peruse reliable curators on blogs and Twitter for news and essays. I ignore most “breaking news” that isn’t immediately relevant to me, and instead look for carefully researched work. Some of this is necessary because I need to stay up on what is happening with capital markets and technology. News is often bullshit, but its entertaining, and I often get useful ideas piecing together trends.

For actual books though publication date isn’t quite as important. I generally choose non-fiction books three ways: (1) Focused on a particular topic (2) timeless deep reading (3) timely speed reading.

Random topics

When I’m interested in a topic, I’ll skim whatever book I can find about it, and sometimes find a few valuable ideas. This applies not just to business, but life in general. In the past year this has included topics as wide as gilded age businesses, securities law, uranium mining, and child psychology. I like to see not just what the “accepted wisdom” is, why and how it came to be widely accepted, and if it is likely to be correct. Reality is rarely black and white.

Timeless deep reading

When I hear smart people talking about books that are a few years old, I listen closely. Often the most valuable books are those that have stood the test of time. Core concepts stay relevant, even if the technological specifics change. Information Rules by Hal Varian and and Technological Revolutions and Financial Capital by Carlota Perez are prime examples of this category that have become important influences on my thinking. Similarly, historical biographies are almost always relevant decades after publication.

Timely speed reading

Many newer non-fiction books, have a couple key ideas that make them worth reading. Yet sometimes authors stretch a great potential blog post into a long fluffy book. Sometimes I can get the key point from listening to podcast interviews with the author.

If I listen to an interview, and it seems like there is more depth than can be captured in an interview, I’ll consider getting the book.Often I’ll first see if I can get an audio book version from the library via Libby. Then I’ll download the key ideas(at 2x speed) into my head while working out or walking to work. If I listen to the audio book, and I find myself needing to pause and take notes, or wanting to capture quotes, then I’ll look at getting a kindle or dead tree version of the actual book.

I’ll skim through books that present well known ideas in unique ways, but reserve my deep focused reading for life changing insights. Of course sometimes being presented with a familiar idea will have more salience based on new experiences or just my subjective perception. So this isn’t an objective filter, even though I sometimes try to make it so.

There are of course exceptions to this filtering heuristic. There are a few familiar authors whose books I’ll buy right when they come out. I keep a lot of random books all around the house, so sometimes I’ll just pick one up and read it. And often serendipity leads me to find good books randomly on Twitter, in the library, or a bookstore.

Fiction

Reading is definitely my thing, too, and I think you have to read not just business stuff but also history, novels, and even some poetry.: Investing is about glimpsing, however dimly, the ebb and flow of human events. It’s very much about breasting the tides of emotion, too, which is where the novels and poetry come in.

Barton Biggs, Hedgehogging

I went through a phase as a non-fiction snob. Who has time to read fiction, I thought? I have since done an almost complete 180 on this thinking. Fiction is more challenging to read and is generally better written than non-fiction. My day job involves reading a lot of dense regulatory and legal filings. There is usually an obvious structure to any given piece. But the broader meta game is piecing together disparate parts into a coherent narrative.

Fiction challenges the reader more because one has to spend more time thinking about what is important, understanding character development, and anticipating a story as it develops. Plus after a day of reading dense legalese and staring at screens, sometimes I want to engage my mind in a new way.

Besides, sometimes you have to refresh your mind and soul by consuming some crafted, eloquent writing.When I get home at the end of a business day, after being absorbed in investment babble and dull, plodding writing, replete with trite phrases such as make no mistake, which is my pet peeve, I am stuffed with babble. My gorge rises at the thought of more business carbohydrates. So I sit down with a nice big glass of wine and immerse myself in something I want to read. I always have at least one book going, and my taste is eclectic, but the sine qua non is that it has to be well written

Barton Biggs, Hedgehogging

I have been reading 3-5 non fiction books for every fiction book I finish, but to start reading fiction again was a major change in this past year. I still don’t have a good heuristic for filtering fiction. I mostly rely on recommendations from smart and interesting people. So send me your recommendations!

Borrowing the east wind

Around 200 BC Chinese strategist Zhuge Liang first used a sales trick still re purposed by consultants and lawyers today.

Zhuge Liang was an amateur meteorologist, and he used this fact to convince people that he could control the weather. His knowledge of meteorology was very basic, something any farmer who paid attention would have known. Nonetheless his enemies didn’t have this knowledge. So it was easy to bamboozle them.

During one battle , he realized that the wind was likely to switch direction in a manner that was highly favorable for his army.

He made sure the enemy saw him do an elaborate ceremony that looked like black magic. He kept at it until the wind changed direction. As a result his reputation as a fearsome indispensable strategist grew massively.

This was featured in the historical fiction Romance of the Three Kingdoms . The phrase “Borrow the East Wind (借东风) refers to this story. Its sometimes used to described taking advantage of a situation.

A bit of dancing, drumming and smoke. Zhuge Liang took basic observation skills and sold them as black magic.

Modern knowledge work

I think of this anytime I see a knowledge worker selling their work makes it look more complex than it really is.

Jargon, chartporn and powerpoint replaces dancing drumming and smoke. Or alternatively with legal and compliance work, fear of regulatory risk leads to a company paying high fees to avoid problems. Even if all that is needed is filing a simple form at the right time.

There is a risk of a similar phenomenon in any business where there is a huge knowledge gap between seller and customer. Will the seller take advantage of that gap in a way that harms the buyer?

Honest selling

It may seem like there is one fundamental problem with this comparison: Zhuge Liang was a diplomat/military strategist. A sales call isn’t a war. Its not supposed to be adversarial!

That might actually be the problem. An honest sales process is about helping the client see the value. The battle is against any misperception not against the client. A dishonest sales process is about taking as much from the client as possible.

Zhuge Liang’s life was on the line. And warfare (against sentient opponents) is all about deception. Deceiving competitors is justifiable. But deceiving customers is not. Some businesses may feel their life is on the line, but I bet they could make a good living by reducing complexity rather than playing it up. I know I’m willing to pay up for reduced complexity!

Meta-Game

Dealing with this issue has proved to be a major challenge in dealing with lawyers, compliance consultants and technology contractors. I’ll ask around and get quoted absurdly large price ranges for the same set of work.

I’m getting better at asking the right questions in order to see what services are really worth.

I place great value on lawyers, consultants and developers who can cut through the bullshit.

The Life and Mental Models of John Boyd

“Fuck a wind tunnel. The biggest wind tunnel in the world is up there. Its called reality.”

-John Boyd

John Boyd’s OODA loop is in my opinion one of the most valuable mental models to apply in basically all aspects of life, especially where there is high stakes competition. Boyd’s life makes for an entertaining bio, and Boyd: The Fighter Pilot Who Changed The Art Of War is one of the first completely detailed versions to cover his development as a person, and strategist.. The book develops his character through a series of political battles and personal trauma”. He had an intense belief in empirically testing everything, and he was willing to struggle in the wilderness for decades until he got everything right. His bio tracks how his thinking evolved over time, culminating in several important aeronautical engineering theories, along with the OODA loop.

“Do not write it as a formula. Write it as a way to teach officers to think, to think in new ways about war. War is ever changing and men are ever fallible. Rigid rules simply won’t work. Teach men to think.”

“If you want to understand something, take it to the extremes or examine its opposites,”

The OODA loop

The quick version:

… to shape the environment, one must manifest four qualities: variety, rapidity, harmony, and initiative.

A commander must have a series of responses that can be applied rapidly; he must harmonize his efforts and never be passive. To understand the briefing, one must keep these four qualities in mind. After marching through commander must operate at a faster OODA Loop than does his opponent.

Boyd said there are two ways to manipulate information gleaned from observation: analysis and synthesis. We can analyze whatever process or event we are observing by breaking it down into individual components and interactions. And from this we can make deductions that lead to understanding. Or we can synthesize by taking various sometimes unrelated components and putting them together to form a new whole.

Key quotes on the OODA loop and related theories:

The purpose of the briefing was not to reveal the “Answer” but to jar listeners out of complacency and into thinking on their own. Boyd abhorred the idea that his briefing might be considered dogma. In fact, he often said listeners should take the briefing out and burn it before they considered it dogma.

Boyd found many such instances in history, and in these victories by numerically inferior forces he found a common thread: none of the victorious commanders threw their forces head-to-head against enemy forces. They usually did not fight what is known as a “war of attrition.” Rather, they used deception, speed, fluidity of action, and strength against weakness. They used tactics that disoriented and confused—tactics that, in Boyd’s words, caused the enemy “to unravel before the fight.”Becoming oriented to a competitive situation means bringing to bear the cultural traditions, genetic heritage, new information, previous experiences, and analysis / synthesis process of the person doing the orienting—a complex integration that each person does differently. These human differences make the Loop unpredictable. In addition, the orientation phase is a nonlinear feedback system, which, by its very nature, means this is a pathway into the unknown. The unpredictability is crucial to the success of the OODA Loop. Only three arrows are on the main axis, and these are what most see when they look at the Observe > Orient > Decide > Act cycle. But this linear understanding and its common result—an attempt to use the Loop mechanically—is not at all what Boyd had in mind.

Application of OODA Loop:

The ability of an aircraft to perform fast transients does two things, one defensive and one offensive: it can force an attacking aircraft out of a favorable firing position, and it can enable a pursuing pilot to gain a favorable firing position. The advantage gained from the fast transient suggests that to win in battle a pilot needs to operate at a faster tempo than his enemy. It suggests that he must stay one or two steps ahead of his adversary; he must operate inside his adversary’s time scale.

Thinking about operating at a quicker tempo—not just moving faster—than the adversary was a new concept in waging war. Generating a rapidly changing environment—that is, engaging in activity that is so quick it is disorienting and appears uncertain or ambiguous to the enemy—inhibits the adversary’s ability to adapt and causes confusion and disorder that, in turn, causes an adversary to overreact or underreact. Boyd closed the briefing by saying the message is that whoever can handle the quickest rate of change is the one who survives.

The danger—and this is a danger neither seen nor understood by many people who profess a knowledge of Boyd’s work—is that if our mental processes become focused on our internal dogmas and isolated from the unfolding, constantly dynamic outside world, we experience mismatches between our mental images and reality. Then confusion and disorder and uncertainty not only result but continue to increase. Ultimately, as disorder increases, chaos can result. Boyd showed why this is a natural process and why the only alternative is to do a destructive deduction and rebuild one’s mental image to correspond to the new reality. Thomas Kuhn, a philosopher of science, and Joseph Schumpeter, an economist, recognized the destructive side of creativity. But Boyd was unique in his explanation of how the process is grounded in fundamentals discovered by Godel and Heisenberg and by entropy.

What will be the scene at your funeral?

Boyd was both a thinker and a doer, the quintessential man in the arena.

Boyd saw himself as a man of principal fighting superiors to do what was best for his country. He wasn’t one to suffer fools, or careerists, or bureacrats beyond the minimum military courtesy required.He took enormous career risk in order to advance the intellectual caliber of the US air force. He document and codified with mathematics techniques that truly worked in the air. This made the world a safer place.

Over time he built up a team of proteges who admired him intensely.

“Boyd’s Acolytes minimize his faults. They say it is more important that his core beliefs were steel-wrapped and his moral compass was locked on true North, that he never misspent his gifts. His motivation was simple: to get as close as possible to the truth. He would have been the first to admit there is no absolute truth. But he continued chasing something that was always receding from his grasp. And in the pursuit he came far closer to the unattainable than do most men. “

This was the description of the eulogy that one of Boyd’s proteges gave for him:

“Not many people are defined by the courts-martial and investigations they faced,” raucous laughter echoed off the white walls of the chapel. Sprey told how Boyd once snapped the tail off an F-86, spun in an F-100, and how he not only stole more than $1 million worth of computer time from the Air Force to develop a radical new theory but survived every resulting investigation. Chuck Spinney, a boyish Pentagon analyst who was like a son to Boyd, laughed so loud he could be heard all across the chapel. Even those in the congregation who barely knew Boyd took a certain pride in his profanity and coarseness and crude sense of humor. He cared little for his personal appearance and could be demanding, abrasive, and unreasonable. And while in his professional life Boyd accomplished things that can never be duplicated, in his personal life he did things few would want to duplicate.

Work Habits

Boyd’s work habits, were, um, interesting. Here was the perspective of one of his colleagues:

He would look up from his work to see Boyd staring at the wall, oblivious to the world, for maybe fifteen or twenty minutes. Boyd was, as he described it, “having a séance with myself.” Then it was as if a switch had been turned on: suddenly Boyd spun around in his chair and picked up the conversation, waved his arms like a windmill in a hurricane, leaned across his desk.

…

Boyd went to the library—it was open until 1:00 A.M.—and continued working on equations. He made a list of what had to be done next, which equations had to be written and solved, what theories must be followed up and developed. He filled sheet after sheet of his yellow legal pad. When the library closed he drove up Buford Highway, turned onto McClave Drive, entered his home and continued working. Then he called Spradling( colleague with who he worked). It was about 4:00 A.M. in Atlanta, three hours earlier in Las Vegas.

…

Boyd, as a senior officer, lived in a trailer. By all accounts he worked eighteen- and twenty-hour days. He bought a reel-to-reel tape deck, and every night as he did paperwork his trailer was filled with the ominous “Ride of the Valkyries” or the majestic “Entry of the Gods into Valhalla.”

…

His search ranged far afield. From the base library he checked out every available book on philosophy and physics and math and economics and science and Taoism and a half dozen other disciplines. He was all over the map, searching but not quite knowing for what.

…

It was obvious from Boyd’s phone calls that he was not only spending a disproportionately large amount of his retirement pay on books but was reading them all. Christie’s phone might ring at 2:00 A.M. and when he picked it up Boyd would say, “I had a breakthrough. Listen to this.” And without a pause he would begin reading from Hegel or from an obscure book on cosmology or quantum physics or economics or math or history or social science or education. Christie thought Boyd had taken leave of his senses. Except for the year at NKP, the past nine years of Boyd’s life had been devoted to hosing his superiors. He was a man of action. But when he walked out of the Building, he walked into a world of ideas. There was almost no transition. One day he was on the phone checking on the progress of the F-16 and the next he was calling people at 2:00 A.M. to read German philosophy. And for what? What was this learning theory he kept talking about? He said he had begun work on the thing back at NKP and he still had nothing to show for it. Why didn’t Boyd just retire?

Underestimated

One of John’s favorite stories, one he was to tell all his life, revolved around entering high school on September 2, 1942. He said he took a series of tests, one of which showed he had an IQ of only ninety. When offered the chance to retake the test, he refused. The test gave John what he later said was a great tactical advantage in dealing with bureaucrats—when he told them he had an IQ of only ninety, they always underestimated him.

Of course Boyd did have an advanced degree in aeronautical engineering. So he obviously wasn’t dumb. Apparently he worked harder than anyone at checking every single equation he worked on. Even if he wasn’t the smartest, his intense study over his lifetime allowed him to make all the important contributions that he did.

The right side of history

The 1960s were years of protests and demonstrations on college campuses across America. But not at Georgia Tech. In 1961 the president of Tech called a mandatory all-student meeting and announced that the first black students had been accepted, that all students would welcome them in friendship and cordiality, and any student who behaved otherwise would be dismissed and there would be no appeal. Thus, Tech became the first desegregate peacefully and without being forced to do so by court order. Tech and its students were too serious about academics to become sidetracked by such issues. During the 1960s the most avant-garde activity at Tech was the English professor who sometimes held classes at Harry’s Steak House on Spring Street. This professor’s “liberalism” was the talk of the campus.

Unconventional technique of internal politics and internal diplomacy

If your boss demands loyalty, give him integrity. But if he demands integrity, then give him loyalty.

In his new job, Boyd saw problems that needed immediate attention everywhere he looked. But 7th Air Force sent down paperwork daily that took hours to answer. Boyd thought Air Force bureaucracy was keeping him from the job at hand. His solution was to respond but to add material that caused 7th Air Force more paperwork than 7th Air Force caused him. “Pain goes both ways,” he said. In only a few weeks the time-consuming requests from 7th Air Force shrank to almost nothing.

John Boyd as a diplomatic representative

Then there was the story of the junior officer who was having an affair with a Thai woman. There was nothing unusual about this. Thai women are extraordinarily beautiful and many American officers formed close relationships But this particular officer was married and soon was overcome with guilt. He broke off the relationship. The woman in question was the daughter of an influential village official who felt his family lost face when his daughter was spurned. He was about to charge the young officer with rape. Boyd said he called in the young officer and gave him the big picture of how many base activities depended on the good will of Thai officials. He ordered the young officer, guilty or not, to continue the relationship.

“I’m giving you a direct order to screw her every night until you are transferred out of here,” Boyd said he told the officer. “Sir, I don’t believe that is a lawful order,” the officer said. “Goddammit, I issued it and you better obey it. We’re at war and bigger things are at stake here than your guilt. Your dick can cause you problems but it is not going to cause problems for America. You do as I say or I will make your life a living hell

Hey, sometimes a guy needs to take one for the team.

Boyd also thought the Base Exchange (B-X) at NKP was an unnecessary indulgence. He said a store selling everything from hair dryers to television sets to stereos had no place on a combat base—that such things made Americans “soft.” Persky recalls that once, he and Boyd were talking when Boyd pointed at the B-X and said everything in the store should be loaded aboard C-130s and parachuted into North Vietnam. “Let them get used to the good life and then we can just walk in and take over,” he said. Boyd also dealt with situations

Seems Capitalism did sort of do this in the long run.

Decentralized Management

In a Blitzkrieg situation, the commander is able to maintain a high operational tempo and rapidly exploit opportunity because he makes sure his subordinates know his intent, his Schwerpunkt. They are not micromanaged, that is, they are not told to seize and hold a certain hill; instead they are given “mission orders.” This means that they understand their commander’s overall intent and they know their job is to do whatever is necessary to fulfill that intent. The subordinate and the commander share a common outlook. They trust each other, and this trust is the glue that holds the apparently formless effort together. Trust emphasizes implicit over explicit communications. Trust is the unifying concept. This gives the subordinate great freedom of action. Trust is an example of a moral force that helps bind groups together in what Boyd called an “organic whole.”

What Private Equity Has In Common with Renaissance Charlatans

No man need despair of gaining converts to the most extravagant hypothesis who has art enough to represent it in favorable colors.

-David Hume

Sometimes the private equity industry reminds me of travelling charlatans in late Renaissance Europe. I recently reread Robert Greene’s The 48 Laws of Power, and realized that Law 32 “ Play on People’s Fantasies” must be the guide some people use to draft fund pitchbooks.

( I refer to“Private Equity” or “PE” , but the same general logic applies to the entire alternative investments industry. This includes venture capital, some hedge funds, non-traded REITs, etc. )

PE funds have long term lock ups. The lack of mark to market smooths out volatility. It looks nice on a statement to see something holding steady as markets tank. There can be good reasons for long lockups. Many investments genuinely take a long term to workout. Most short term price fluctuation in the public markets is noise that some find hard to ignore. Warren Buffett once remarked that he bought stocks with the idea that public markets could close for a decade, and it wouldn’t bother him. But often unscrupulous fund managers use questionable marketing techniques and exploit the ability to keep money locked up for a long time.

Marco Bragadino, Private Equity Fund Manager

Often allocators or wealthy individuals will seek out private equity and other alternative investments because of frustration with public markets. Maybe the mark to market volatility has been painful. Perhaps the index funds squeezed all the alpha out of the markets. Maybe they feel that better connected people have access to investments. If only they also had access they too could grow their wealth for multiple generations. Plus they might have something to brag about at cocktail parties or in the nursing home.

Similarly, Marco Bragadino, or Il Bragadino was a famous Charlatan who first targeted Venice in the late 1500s, a time that the city was gripped with the feeling that its best days were behind it. The opening of the “New World” transferred power to the Atlantic Side of Europe. Venice struggled to keep up with the Spanish, Portuguese, Dutch, and English. Worse yet, The Turks were making incursions into Venice’s mediterranean possessions.

Now noble families went broke in Venice, and banks began to fold. A kind of gloom and depression settled over the citizens. They had known a glittering past — had either lived through it or heard stories about it from their elders. The closeness of the glory years was humiliating. The Venetians half believed that the goddess Fortune was only playing a joke onthem, and that the old days would soon return. For the time being, though, what could they do?

Exclusivity

Many alternative asset managers claim to have proprietary models, and tend to give of an air of exclusivity. Madoff, who managed a fraudulent hedge fund, was an extreme example of this. If only investors have the right “access”, they too can get exposure to that magic investment. This is right out of Il Bragadino’s playbook:

In 1589 rumors began to swirl around Venice of the arrival not far away of a mysterious man called “II Bragadino,” a master of alchemy, a man who had won incredible wealth through his ability, it was said, to multiply gold through the use of a secret substance. The rumor spread quickly because a few years earlier, a Venetian nobleman passing through Poland had heard a learned man prophesy that Venice would recover her past glory and power if she could find a man who understood the alchemic art of manufacturing gold. And so, as word reached Venice of the gold this Bragadino possessed — he clinked gold coins continuously in his hands, and golden objects filled his palace — some began to dream: Through him, their city would prosper again.

Modern asset managers are known for having well scripted due diligence meetings that leave investors with a feeling of awe and urgency. Il Bragadino did this too:

Members of Venice’s most important noble families accordingly went together to Brescia, where Bragadino lived. They toured his palace and watched in awe as he demonstrated his gold-making abilities, taking a pinch of seemingly worthless minerals and transforming it into several ounces of gold dust. The Venetian senate prepared to debate the idea of extending an official invitation to Bragadino to stay in Venice at the city’s expense, when word suddenly reached them that they were competing with the Duke of Mantua for his services. They heard of a magnificent party in Bragadino’ s palace for the duke, featuring garments with golden buttons, gold watches, gold plates, and on and on. Worried they might lose Bragadino to Mantua, the senate voted almost unanimously to invite him to Venice, promising him the mountain of money he would need to continue living in his luxurious style — but only if he came right away.

But look at that Sharpe Ratio!

Some private equity fund managers will claim a superb track record without ever having an exit. Sometimes legacy funds will be valued higher, but fail to provide any cash flow. Sometimes those legacy funds work out, but sometimes are actually complete disasters and the manager is delaying the inevitable reckoning.

Again, this is something they could have learned from Il Bragadino:

Bragadino had only scorn for the doubters, but he responded to them. He had, he said, already deposited in the city’s mint the mysterious substance with which he multiplied gold. He could use this substance up all at once, and produce double the gold, but the more slowly the process took place, the more it would yield. If left alone for seven years, sealed in a cas-

ket, the substance would multiply the gold in the mint thirty times over. Most of the senators agreed to wait to reap the gold mine Bragadino promised. Others, however, were angry: seven more years of this man living royally at the public trough! And many of the common citizens of Venice echoed these sentiments. Finally the alchemist’s enemies demanded he produce a proof of his skills: a substantial amount of gold, and soon.

Sometimes mark to market is indeed mark to fantasy.

Finding new suckers

When an asset manager fails to deliver with one target fundraising channel, they look to others. There is nothing wrong with expanding and diversifying a business. But I get suspicious when a fund manager suddenly shifts their whole targeted capital base. Especially when they shift from institutional to retail. Like certain modern fund managers, Il Bragadino focused on finding new clients when became increasingly suspicious of his unfulfilled promises.

Lofty, apparently devoted to his art, Bragadino responded that Venice, in its impatience, had betrayed him, and would therefore lose his services. He left town, going first to nearby Padua, then, in 1590, to Munich, at the invitation of the Duke of Bavaria, who, like the entire city of Venice, had known great wealth but had fallen into bankruptcy through his own profligacy, and hoped to regain his fortune through the famous alchemist’s services. And so Bragadino resumed the comfortable arrangement he had known in Venice, and the same pattern repeated itself.

Believe in the smart people

Yet fund managers, even bad ones, often get incredibly rich in spite of not adding much value to their investors. Their talent is in exploiting human psychology, not investing. It all links back to their ability to exploit people’s need to believe:

His obvious wealth confirmed his reputation as an alchemist, so that patrons like the Duke of Mantua gave him money, which allowed him to live in wealth, which reinforced his reputation as an alchemist, and so on. Only once this reputation was established, and dukes and senators were fighting over him, did he resort to the trifling necessity of a demonstration. By then, however, people were easy to deceive: They wanted to believe. The Venetian senators who watched him multiply gold wanted to believe so badly that they failed to notice the glass pipe up his sleeve, from which he slipped gold dust into his pinches of minerals. Brilliant and capricious, he was the alchemist of their fantasies — and once he had created an aura like this, no one noticed his simple deceptions.

Psychology of Avoiding Charlatans

There is a paradox here. In most cases, it is better to make investments with the intention of making money over decades, not quarters. Yet that is not a reason to not monitor progress. There are many great alternative asset managers who deliver massive value to their clients over decades. I know from experience that they are usually straight shooters.

Charlatans exploit default tendencies in human psychology. Therefore we must guard against this. Building wealth requires discipline. There is no magic investment that will solve everything. People don’t want to hear that, and the Bragadinos of the world prey on this by giving easy answers. Its critical to get comfortable with being uncomfortable. The market doesn’t owe anyone a good return. We must monitor our own psychology as much as the activity of our fund managers.

Constant vigilance is needed to avoid getting tricked by the Bragadinos of the investment world.