Category: Investing

Highlights From Recent Hedge Fund Letters: 2019Q3

I love reading investment fund letters. This business requires a rare combination of variant insight and brutal intellectual honesty, which the best managers express in their writing. My highlights from the best letters I read this quarter are below, in no particular order. In this piece I mostly avoid quoting on specific stocks, and focused on broad investing and psychology themes. You can find plenty of investment ideas by following the links to the letters. This quarter several funds discussed the value/growth divide, the underappreciated risk of inflation(or deflation), business impact of negative interest rates, and mental model challenges in investing.

Thanks to the generous curators that make this possible. Mine Safety Disclosures is probably the best single source for hedge fund letters. They’ve sought out and organized many off the beaten path managers that I wasn’t reading before. The investment letter page on Reddit is another great source. I found several of these letters on twitter as well.

Vltava Fund

Vtltava Fund had one of my favorite letters this quarter. Here is their perspective on hyperbolic discounting :

I always say that one can learn a lot just by looking around oneself, seeing how the world works as well as how people perceive it. The way people perceive the world is then reflected in how investors (a subset of people) perceive the events on the capital markets (a subset of the world). The aforementioned tendency to overestimate short-term events and underestimate the importance of longterm trends is very strongly demonstrated in both cases. (Finance theory even has a name for this: hyperbolic discounting.)

On long term vs short term:

If we as investors were to profit from shortterm events, we would have to be able to recognize the truly fundamental ones in real time as they are happening. This is practically impossible, and even the effort to do so might bring very negative results, because in most cases it will transpire that one has overreacted to something that in the end will have been of no practical importance. We find it is much better to take the approach of betting on long-term expected developments in society.

One of the most cogent defenses of the valuable role that the finance sector can play in society:

For the capital market to work well and efficiently and for it to allocate capital at low costs, there must exist a sizeable number of entities of various types. Vltava Fund is one of those entities. Our role in the overall system is twofold: we act as intermediaries and analysts. We collect free capital from investors who want to invest and then analyse the individual investment opportunities to determine those into which we invest the collected capital. Even though we are just a tiny cog in the gigantic global markets machine, I am very proud of the work we do and how all of us associated with investing in Vltava Fund contribute collectively to the general progress, growth of wealth, and betterment of society.

Tollymore

Tollymore on epistemic humility and the Gell-Mann effect:

Serious media publications invent stories to explain outcomes, without the resources or inclination to determine causality. This often manifests itself in major descriptive U-turns as the outcome changes with the wind. The matters about which financial and political journalists opine are complex. This limits the mechanism to scrutinise these stories and hold their authors to account. And there is value to their readers and listeners, who can paraphrase talking heads’ memorable soundbites at cocktail parties rather than acknowledging ignorance or retrieving the relevant facts from their addled brains. Authority bias plays a role: media appearance confers credibility, the belief in which is counter to independent thought and self-awareness. Unsubstantiated conjecture is rife. As Mr. Crichton puts it: “one problem with speculation is that it piggybacks on the Gell-Mann effect of unwarranted credibility, making the speculation look more useful than it is”.

The goal of epistemic humility is consistent with maintaining a careful distance from today’s media. To exercise good judgement, we should shield ourselves from the Gell-Mann effect. Financial markets, political and economic systems, unlike meteorology, are reflexive; participants are second guessing one another and the bases on which decisions are made are altered by the decisions themselves. Speculation thrives because it is cheap and speculators are not held to account, but forecasting is foolish when nobody knows the future.

Epistemic humility is a key concept I try to apply in my approach to life.

Greenhaven Road

Greenhaven Road discussed how they subdivide investments in high quality companies into those that are bets on the status quo continuing, vs those that are bets on the status quo changing.

They are also SPAC curious. They rarely do SPACs, but interesting what he goes through when he does they go to extreme lengths to compete due diligence, which they discuss in a case study.

Also, they have decided to make an investment in South Africa, which is a bit unusual for them. Here is some of their reasoning:

Why Bother with South Africa? For me, there are two parts to the answer. The first is a desire to hold some non-U.S. companies. While it is true that the world catches a cold when the United States sneezes, South Africa is in the interesting position of having not meaningfully participated in the last decade’s equity market growth due to poor political leadership, poor policy choices, and corruption. I believe that new leadership and positive reforms are likely to place South African equity markets in a position to be less correlated to developed equity markets yet produce positive returns, albeit more volatile. This is intended to be rational diversification.

The second and more important reason to venture to South Africa is the potential for returns. With a bit of continued growth, operating leverage, and anything approaching a fair multiple, I believe that the price of the shares we are acquiring could very realistically go up 5X. A hundred things can prevent that type of return from being realized, but given how absolutely beaten down South Africa is from a valuation perspective, any return to normalcy could produce abnormally positive returns.

They have some great points. We’ve also found opportunity in Africa.

Alta Fox Capital

Alta Fox on the concept of zooming in and zooming out:

The concept of “zooming in and out” is an important one for my investment process, both from a single idea and a portfolio construction perspective.

For any individual idea, it is important to “zoom in” to understand the unit economics of a business, appreciate the finer nuances of the financial model, and to develop a sound valuation technique. However, it is equally important to “zoom out” and to understand at a higher-level what could go wrong, develop intuition for risk and uncertainties that transcend a few valuation scenarios, and know when to ride winners or when to fold losers. For a broader portfolio management perspective, it is also important to zoom in and out. It is important to track performance relative to indices over time as that is ultimately the measuring stick, and if the market is disagreeing with you, it is important to know why. However, one has to zoom out and focus on the process because too much focus on short-term performance is absolutely detrimental to day by day decision-making.

The abilities to zoom in and out are different skills. This is one of the primary distinctions between a good analyst and a good portfolio manager. They have complementary, but different, skill-sets. An analyst is most often tasked with “zooming in,” which normally involves ripping a business apart and understanding the filings at a very rigorous level. A portfolio manager, on the other hand, must have an overarching philosophy on how to allocate scarce research time to specific ideas, passing on others, how to size positions, etc. The best investors are capable of simultaneously zooming in and out.

Firebird Management

Firebird on negative interest rates:

In theory, companies trade at the present value of all future earnings. There are two key inputs to this: earnings and the discount rate. Companies that are growing earnings faster should be valued higher than companies with a slower growth rate, but how much more depends on the discount rate.

Consider a simple thought experiment at different interest rates: Company A is growing earnings at 2% per annum while Company B is growing at 15%. At a 7% blended discount rate, Company A is worth 17x this year’s earnings, while company B is worth 107x! Company B is value higher but has a much higher sensitivity to interest rates. A mere 1% change in the blended discount rate leads to 35% drop in value of Company B, while Company A valuation drops by only 15%

Note we also wrote up an extensive Negative Interest Rates Thought Experiment here. The implications across the economy are startling.

Of course, so are the implications of reversing negative interest rates, as Firebird points out:

In the U.S. market, growth companies have been outperforming value dramatically since the beginning of 2015, when we first started seeing corporate debt trading in negative territory. We believe that this outperformance is in large part due to repricing the cost of capital in light of the likelihood that low rates could persist for longer than originally anticipated. With the negative impact of low rates becoming more apparent every day, it is not surprising that the market reacted to the possibility that the policy of low negative interest rates may be in question.

Third Point

According to Third Point, the markets aggregate results have masked a “tumultuous factor rotation” taking place underneath the surface.

In August, equity portfolios tied to momentum or the near inverse – “laggards” – outperformed, as markets inflated assets reflecting economic weakening in a low inflation/low growth world. These momentum asset biases – favoring large cap over small cap stocks, growth versus value, or “min vol” strategies – became increasingly correlated, crowded, and sometimes expensive. The equation extended itself more acutely in secular growth names and similarly punished unloved shorts.

Third Point has increased its emphasis on activism. Currently activist names account for 40% of their assets, the highest percentage in history.

Askeladden Capital

Askeladden Capital’s letter this quarter reflected a maturing process. They discuss the limitations of primary research, and how their approach to risk has changed:

In certain circumstances (such as levered companies), we have become far more conservative, and less willing to underwrite certain outcomes with any confidence whatsoever. In other circumstances (such as recurring revenue businesses), we have become far less conservative, and far more willing to underwrite certain outcomes with a high degree of confidence. We have become more aggressive in underwriting knowable factors which we can understand better through thorough research and become far more conservative in underwriting unknowable factors which we generally believe cannot be elucidated by research to a degree helpful for the investing process. When we aren’t sure if something is knowable or unknowable, we like to default to ´unknowable for conservatism -overconfidence is killer in our business.

Nuances like these are what drive outperformance …

The letter was also full of links to articles on mental models. Separate letter for clients that includes specific positions. I won’t disclose any specific positions , but I will say as a client that performance has been solid, and there are several intriguing investments currently in the portfolio.

Comus Investments

Comus Investment’s letter had some intriguing criticism of dividend investing:

Firstly the term dividend- investor makes no sense at all to me, and it makes even less sense than the fabricated demarcation between supposed growth and value investors. Dividend- investing often implies that one is investing with the goal to receive a currently yield at the expense of long term capital appreciation as if the two sources of returns are distinct(they aren’t)

Also, notable discussion on absurdities in the valuation in SAAS companies

Any tech investors reading this will likely roll their eyes given how often they are mentioned but I have to bring up the SAAS basket of stocks. I believe it is lower now, but last I saw the entire group of public SAAS-related stocks was valued above 10x sales. This is similar to 100 fishermen at a single lake estimating they can each catch a fish a day with only 10 fish in the lake- for the fishermen to be right the fish will have to reproduce extremely quickly. The entire industry is valued as if every investor will do extraordinarily well and each business is valued as if it will experience organic ROE’s of 20%+ for decades.

Theye also had an interesting point about how accounting changes (ASU 2014- 09B) will influence SAAS accounting

Punch & Associates

In their latest letter, Punch & Associates frames a fascinating discussion around the parallels between the Screwtape Letters (great book) and the emotional and psychological challenges investors face. Screwtape Letters are fictional letters from Screwtape, to his nephew Wormwood, part of an underworld organization charged with taking souls from people trying to live a righteous life.

parallels exist between the forces (temptations, distractions, habits) acting on the Patient and the forces impacting the hearts and minds of individual investors. While these forces may not be described as demonic (some may be), and while the fate of one’s soul may not hang in the balance, the fact that these forces exist and that we are all vulnerable at times does indeed matter. The world is not perfectly architected so that you can get rich, beat the S&P 500, or even reach your financial goals. Quite the opposite.

People’s lives go through peaks and troughs, and this impacts thaeir ability to live a good life. Similarly, peaks and troughs in the market impact people’s ability to make rational decisions.

Closely related, there are great lessons for dealing with temptation of noise:

Noise is something that we all deal with in investing and in our lives. Like Wormwood’s whisperings, it’s constant. Noise can enter into your life and cloud both your judgement and priorities. People are subject to it one moment, and then they are not. The effect of noise, therefore, undulates. It’s not enough, however, to occasionally ignore noise, because mistakes are made in moments. Wormwood’s efforts are like the noise we encounter today, constantly whispering in our ears.

Pangolin Investment Management

Pangolin Investment Management is focused on Asia, and their August letter made some interesting points about tax policy in Southeast Asian countries . Also they have some commentary on a challenging history/geopolitics situation in Indonesia. In their October letter Pangolin discussed car racing in Malaysia, and the broader meaning implications for emerging markets.

Lifestyles are changing quickly in Asia. Motor racing with all its glamour is a million miles away from Lombok’s subsistence padi farming of 20 years ago. Here, income growth lifts people from being poor farmers to basic consumers, and then on to becoming middle class discretionary spenders.

It’s not just about a GDP growth, but the massive change in people’s lifestyles that accompanies it.

Ensemble Capital

Ensemble Capital on the three types of traps they avoid:

We’ve identified three traps we want to avoid. First, the commoditization trap. This is when there’s strong management in place and an easy-to-understand business, but either a non-existent or narrowing moat. Much of a company’s intrinsic value is driven by its so-called “terminal value” – the value the business will create over the very, very long term. As such, if we’re not confident that a company can maintain or widen its economic moat beyond 5 or 10 years, estimating terminal value becomes increasingly difficult. In this circumstance, long-term returns on invested capital and growth – the two pillars of our valuation model – can decline faster than might otherwise be expected. Some investors are comfortable making a bet on a company decline being slower than market expectations – and that’s another way to make money – but we think that’s a dangerous game and one we intentionally avoid.

The second trap is a stewardship trap. This is when there’s evidence of a durable moat and an easy-to-understand business, but we lack confidence in management. We live in a hyper-competitive economy where cheap and abundant capital and new advertising platforms have made it easier than ever for challengers – whether that’s a startup or Amazon – to take on lazy incumbents and chip away at their business. Because of this, we require our companies to be managed by what we consider to be good business stewards. Our management teams need to understand how to create sustainable value and thoughtfully allocate capital.

The final trap is the complexity trap. This is when we like management and think there’s a durable moat, but we just can’t get comfortable understanding the business. Sometimes the reason is that we lack requisite domain knowledge in a specialized field. Other times, the financials are opaque, or the business operates in multiple competitive arenas and we struggle to grasp unit economics. Before investing in any company, we want to appreciate the known risks and the so-called “known unknowns” about the business, and a lack of understanding prevents us from achieving this.

Artko Capital

Artko Capital’s latest letter included discussion on investment business challenges of focusing on microcaps. Although returns in the space are lucrative, structural reasons that opportunities are left for smaller funds. Also includes a great case study on handling portfolio responsibilities as a portfolio manager when investing in turn around type situations.

Andaz Private Investment

Andaz Private Investment’s latest letter includes some provocative commentary on the real meaning of inflation statistics:

There is a prevailing argument out there that inflation is nowhere to be seen, and that deflationary forces are at play e.g. technology replacing workers, offsetting the effects of money printing. In our view, this is naive. The metric used to measure inflation (CPI) is misleading and we would argue, deceptive. In fairness, the Australian Bureau of Statistics makes no attempt to hide this and has the following disclaimer:

“In practice, no statistical agencies compile true cost of living or purchasing power measures as it is too difficult to do.”

Other bodies are not so forthcoming. Central banks have decided that this garbage-in, garbage-out statistical measure is their sacred metric, that 2.0% is their precise target, and will print money until that figure is very close to 2.0% but not over it.

….

The most crucial criteria for investment over the foreseeable future will be to hold assets and securities which can outrun inflation (e.g. businesses which can raise prices or use levers to increase profits/earnings on a per share – again undiluted – basis).

East 72

The East 72 Quarterly letter had some interesting macro discussion on company earnings trends.

Additionally, they also discussed a bunch of super cheap, esoteric investment/asset holding company investments. Listed investment companies in Australia seem like an especially interesting hunting ground these days.

It has been noteworthy that the mania surrounding Australian LIC’s, rather than subsiding, has turned to near derision in some cases. This is leading to a number of corporate actions and activist behaviour designed to close up value gaps or force liquidation against hefty fee imposts for “me-too” investment strategies. …

We have always held the belief that having permanent capital available means that a far more esoteric/illiquid investment strategy can be pursued (in essence, that’s the basis of East 72 itself). However, in these situations, care needs to be taken to retain liquidity to ensure discounts to NAV do not blow out.

Saber Capital

Great discussion on the different types of edge in the Saber Capital letter. This comment on time horizon edge is key for long term investors:

….the deterioration of the info edge has actually increased the size of the “time horizon” edge.

GMO

GMO recently released a letter called Shades of 2000:

..many investors made the case in 2000 that long-term averages were not meaningful anymore and the future would be far different from the past. From the standpoint of the world from 200-2010, those investors proved to be wrong as asset prices

Value investing is way out of favor these days, but GMO believes the current environment that value investors have had in 20 years.

Horizon Kinetics

Horizon Kinetics 2019Q3 letter summarizes their current investment positining this way:

The composition of our equity portfolios is intended to avoid making their performance dependent on the continuation of the status quo.

They discuss what type of companies might do well under different scenarios, and include this handy diagram:

Horizon Kinetics’ points out that most investors are all invested in the same group of stocks, and are not prepared for any inflation. Enroute they point out some of the absurdities of ETF land, such as the fact that the same stocks are classified as both growth, value, low vol, high dividend in different indexes.

A couple of interesting statistics, since this discussion is all about diversification. This year through September, the daily price correlation of the following indexes with the S&P 500 were all between 0.86 and 0.98, meaning that their price behavior varied almost identically with the S&P 500: S&P 500 Growth ETF, the S&P 500 Value ETF, the Russell 2000 ETF of small-cap stocks, and the All Country World Index Ex-U.S. The greatest variance, among the major equity classifications was from the Emerging Markets ETF, and that fund mirrored the S&P 500 77% of the time.

People think they are diversified, but they aren’t.

Focused Compounding

Focused Compounding discusses different types of price risks in their investments. They explains why they look for a combination of low share turnover , and low beta in order to identify underfollowed stocks. It contained this gem of a quote :

In investing: beta is like syphilis. If art, cash, gold, or bonds are inherently lousy, low returning assets (barren islands) – then, institutions and individual investors can simply switch into inherently more productive assets like stocks, farmland, timberland, real estate, etc. (fertile islands) and collectively lower the risk they won’t achieve their long-term financial goals.

They use a couple case studies to discuss why their experience has led them to personally prefer “compounders” to asset plays as well.

Silver Ring Value Partners

Silver Ring Value Partners mostly follows a bottom up stock picking strategy. However, they have decided to put on a Minsky style tail hedge, which they discuss in detail in the letter. They looked for for companies that have high debt levels and will need to refinance soon. These companies are most likely to decline severely in a panic. Its a great example of combining micro and macro- of a bottom up investor, productively worrying from the top down.

See also: Thinking and Applying Minsky

Templeton & Phillips Capital Management

Tempelton & Phillips latest letter has interesting commentary on how the value and growth divide is blurring when you look carefully. (see also: Why All Great Investors Are Intellectual Cross Dressers)

Excellent analysis of how intangible assets influence modern balance sheet analysis:

…the assets driving economic gains today are more closely related to Mickey Mouse in nature, than they are to the tangible assets that statistical measures, accounting methods, and valuation methods were designed around in the last century. This reality has created significant challenges for today’s economists and accountants, who still struggle to account for intangible assets that defy being touched, seen, measured, valued, and in some cases even fully understood. Rather than tackle the anomalous values of Mickey Mouse, or the formula for Coke,

economists and accountants today are tasked with collecting, interpreting and recording data representing a widely expanded realm of intangible assets including: in-house proprietary software, customer databases, customer network effects, business processes, and organizational structures. So, while the assets listed above are very real to shareholders, and tend to be more durable than not, the business activities used to create them flow through the income statement as expenses, rather than get recorded on the balance sheet as an investment. In sum, the financial parties that collect and report data to the markets are failing to capture an increasing amount of economic activity tied to today’s growth in intangible assets.

….

One final note here is that we believe in order for a Ben Graham style asset-based valuation approach to be successful today—such as the widely used price to book ratio—the analysis would need to make an estimate regarding the value of intangible assets (not fully reported in financials) in order to calculate a reasonably accurate ratio. Since many intangible assets are not counted in traditional book value, the price to book value without any adjustment appears inflated (and expensive). Similarly, a low price to book ratio without any adjustments implies to us the possible need for asset write-downs or a firm’s reliance on underperforming tangible assets. Since low price to book ratios are a key focus for the “value” indices, we believe

these measures have a bias towards selecting firms with less productive assets. To the extent this is true, this collection of assets are very likely to underperform the overall market, much less the growth stocks where earnings estimates are growing even faster (but may not be sustainable).

White Crane

White Crane discusses the bifurcation of the credit markets between companies that can raise tons of easy money on easy terms, and those unable to raise any at all.

Such bifurcation of credit markets is often witnessed in the latter stages of credit cycles, as the availability of capital erodes. With credit availability becoming finite, lenders allocate only towardsselect borrowers, while others are either forced to pay exorbitant rates or seek other forms of Capital.

In order to take advantage of this market bifurcation, and a potential transition into a broader credit downturn, the Fund has built short positions in a basket of corporate credit securities.

These short positions can be grouped into two categories:

1) Investment grade credits that currently have access to unlimited amounts of low-costcredit; and

2) High yield credits that, in our opinion, do not have access to capital markets – yet are being priced as if they are investment grade credits with unlimited access to inexpensive

The common theme between all the credits in our short basket is that the all-in negative carry is low and they each have specific catalysts that we believe will result in a re-rating of the securities. Through this basket, we have created inexpensive capital structure put options where our downside is limited (i.e. essentially the negative carry) and our potential upside is substantial should our identified catalysts unfold. We expect to continue adding to this basket of credit shortsas the credit cycle becomes increasingly elongated and additional opportunities emerge.

Saga Partners

Saga Partners latest letter on investing in a time of heightened uncertainty

… when is there not a heightened sense of uncertainty in the markets? And when markets do inevitably panic again, as they did in the fourth quarter of last year, will investors then overcome their fears and say now is the right time to invest? Or will they wait until things calm down and become less uncertain?

We are certain that another recession will happen sometime in the future, but we do not know when it will happen, how long it will last, or how extreme it will be. We do not even know how the market will react going into and coming out of it. We do know during 2008 following the Lehman Brothers bankruptcy and subsequent financial meltdown, the outlook at the market lows was far from certain. We prefer to keep our heads down, ignore the noise, and simply look for the best opportunities we can find given the information we have today. As we’ve noted before, more money has been lost waiting for corrections or trying to anticipate them than has been lost in the corrections themselves.

On value vs growth:

A company is neither cheap nor expensive because of where it sells relative to recent fundamentals. These classifications of value or growth are just a convenient box ticking, quantitative oriented practice used by consultants which can distort the investing process. While different styles, genres, or investing factors may go in and out of favor at times, at the end of the day, the value of a stock is all the cash that can be taken out of a company going forward.

They also had a detailed discussion on how fee structure impacts ultimate returns to investors.

Forager Funds

In contrast with Horizon Kinetics, Forager Funds argues that it might actually be deflation for which investors are most egregiously underprepared.

Many investors assume that “what goes down must go up”. Many of our clients lived through the inflation of the 70s and 80s and seee its return around every corner. But what if that period was the anomoly rather than the rule. We all thought that the stimulus andgrowth in money supply after the financial crisis was certain to kick start an inflationary spiral. It hasn’t. In fact, inflation has been worryingly low. Best prepare, I would suggest, for a sustained period of zero rates.

More importantly, what do these zero rates imply about the future of the economy? What if, rather than rates going up, we are headed for a long period of low growth and deflation?

Low nominal rates are not necessarily a panacea for borrowers. It feels like it because the interest payments today are so low. But if we are headed for a deflationary world, its repayments later in life that you need to worry about.

The world might be “turning Japanese. Forager’s research into ASX listed Japanese property trusts leads to some startling conclusion of what that might be like. They were initially intrigued by how the companies were, but then realized that with wages, and rents falling in 18 out of 20 years, they might think they were earning a good return only to one day find the property was worth less than the debt.

Today’s low rates are sending a very important signal. The world is turning more and more Japanese.

If that is the world we are headed for, be very wary of debt.

In addition to this macro commentary, the letter includes a lot of intriguing off the beaten stock ideas in Asia.

What great managers did I leave out? Send me your favorite hedge fund letters.

A Negative Interest Rates Thought Experiment

Toto, I have a feeling we’re not in Kansas anymore

Dorothy in Wizard of Oz

With a negative yielding investment, the price you pay exceeds the sum that you will get back at maturity plus the income you receive in the interim. If you buy a negative yielding bond you are guaranteed to lose money. If the rate you receive on bank deposits is negative, you are guaranteed to lose money.

Negative interest rates are becoming kind of a big deal:

Most negative yielding debt is government debt, which is ironically considered “safe”, at least in first world countries. With government debt, you know what cash flows you will receive during the holding period, and what face value amount of principal you will receive upon maturity. With everything else, cash flow is uncertain and principal is always at risk. Indeed the yield on government debt functions as a proxy for the “risk free rate” , which is a critical input in financial models investors use to make strategic decisions throughout financial markets.

Conservative investors generally prefer to hold a lot of government debt in order to meet future needs. Pensions, banks, and insurance companies are required to hold a minimum percentage of their assets in government debt so they can safely meet obligations to their stakeholders.

Negative interest rates cause a lot of surprising second order impacts throughout the world impacting how people do business.

Options Pricing

The Black Scholes model is one of the pillars of modern finance. It uses the risk free rate as an input but it cannot compute when the risk free rate is negative. It requires users to calculate a logarithm. Yet the logarithm of a negative number is undefined/meaningless. Here is a paper that explored the implications in more detail. Maybe people can use the old Brownian motion models, but there isn’t going to be universal agreement right away on what to use.

Any switchover will create unintended consequences throughout the investment world . Lots of funds hold over the counter options or swaps which must be valued using models in the time between their initiation and expiration or exercise. This valuation impacts the number that appears on the statement of investors. To the extent that investors have asset allocation targets around what percent of the entity’s assets can be invested in what, this will have secondary impacts in other markets. A lot of large firms have to totally change their valuation policies which is never easy to do because valuation departments are plenty busy with their jobs as it is. Markets aren’t going to close just so they can rewrite their valuation policies.

Also, in cases where a swap or OTC option contract requires collateral to be posted as the pricing changes throughout the life of a contract, both sides of the contract need to agree on valuation methods. When interest rates are positive, Black Scholes is a noncontroversial options I doubt contractual language was written in a way that accommodate for a world where Black Scholes would completely stop working.

Currently, more banks are trading a wide number of options without a reliable price. Each bank could handle this problem by performing its own solution, but the lack of a shared approach could lead to serious legal issues.

Source

This stuff is all theoretical but it has real cash impact throughout the world. What types of risks can be hedged will impact how capital can be allocated. How capital is allocated directly impacts what ideas get funded.

Now lets consider the real world impact on different groups of investors.

Stimulating TINA

In theory, negative rates should stimulate the economy. If investors only invest in safe assets, nothing else will get funded. Retirees need income from investments to live, foundations need to earn enough to safely withdraw funds, etc etc. If the bank charges them to hold their cash, they will invest more in real estate, high yield debt, and venture capital etc. They will have to take no more risk because “there is no alternative”(TINA).

However, when you look at how negative rates will impact pensions, banks and insurance companies, its hard to escape the conclusion that they might have a destructive, rather than stimulative impact on financial markets.

Pensions

People live longer than they can work. To prevent a social catastrophe, countries have different ways of providing for old people. Pensions are a big part of the financial markets According to CFA society: Willis Towers Watson’s 2017 Global Pension Assets Study covers 22 major pension markets, which total USD 36.4 trillion in pension assets and account for 62.0% of the GDP of these economies.

In the US people pay into Social Security, which provides a bare minimum standard of living to old people. The Social Security Fund is only allowed to invest in US Treasury Securities. If Treasuries yielded negative, the Social Security Fund will erode over time, meaning it won’t be able to meet its bare minimum obligations to retirees.

Social Security by itself barely provides enough to live on. A lot of people in the US and around the world also have pensions through their jobs as well. The impacts of negative rates get more nuanced and even weirder when you consider how these work.

First of all, extremely low interest rates worsen pension deficits. Future obligations must be discounted backwards. Lower discount rate leads to higher obligations in the present day. On the other side of their balance sheet, they must make an actuarial assumption about future returns on their investments. From what I’ve seen they often make aggressive return assumptions. To try to justify higher return assumptions, they put what they can into riskier investments. To this extent pension funds are partially in the TINA Crowd.

Pensions are generally also obligated to put a certain amount of assets into “safe assets” which are the first thing to start yielding a negative rate. As a result, this negative rate will create a destructive feedback loop.

Gavekal had this story of a Dutch Pension as an example:

One day he was called by a pension regulator at the central bank and reminded of a rule that says funds should not hold too much cash because it’s risky; they should instead buy more long-dated bonds. His retort was that most eurozone long bonds had negative yields and so he was sure to lose money. “It doesn’t matter,” came the regulator’s reply: “A rule is a rule, and you must apply it.”

Thus, to “reduce” risk the manager had to buy assets that were 100% sure to lose the pensioners money.

Pension funds get caught in a feedback loop that will erode their capital base. For example say they buy a 5 year zero coupon bond at €103:

The €3 loss will reduce the market value of assets by €3. Holland also has a rule that pension funds must buy more government bonds the closer they get to being underfunded. Yet buying such negative-yielding bonds and keeping them to maturity ensures losses, making it more likely the fund will be underfunded, and so forced to buy more loss-making bonds (spot the feedback loop). Soon the fund will be distributing returns from capital, rather than returns on capital. Hence,it is not inflation that will destroy pension funds, but the mix of negative rates and rules that stop managers from deploying capital as they see fit. These protect governments, not pensioners who are forced to buy bad paper.

So negative rates will exacerbate the global retirement crisis. Oops.

Banks

What about banks? Negative rates also destroy their capital base, and leave them with less money to actually lend out in the economy. This hits at the heart of how fractional reserve banking works.

According to Jim Bianco at Bloomberg:

For every dollar that goes into a bank, some set amount (usually about 10%) must go into a reserve account to be overseen by the central bank. The rest is either lent out or used to buy securities.

In other words, the fractional reserve banking system is leveraged to interest rates. This works when rates are positive. Loans are made and securities bought because they will generate income for the bank. In a negative rate environment, the bank must pay to hold loans and securities. In other words, banks would be punished for providing credit, which is the lifeblood of an economy.

Gavekal explains how this leads to an eroding capital base (using the same 5 year zero coupon bond as the pension example above):

As a leveraged player, let’s assume it lends a fairly standard 12 times its capital. This capital has to be invested in “riskless” assets that are always liquid. In the old days, this would have been gold or central bank paper exchangeable into gold. Today, the government bond market plays the role of “riskless” (you have to laugh) asset, which has no reserve requirement. As a result, banks are loaded up with bonds issued by the local state. Now let us assume that a bank has just lost €3 on the zerocoupon bond mentioned above. The bank’s capital base will be reduced by €3. Based on the 12x banking multiplier, the bank will have to reduce its loans by a whopping €36 to keep its leverage ratio at 12. Hence, the effect of managing negative rates while also respecting bank capital adequacy rules means that the capital base can only shrink.

Insurance Companies

One of the main ways that insurance companies make money is by collecting premiums in advance of paying out any claims. Hey are able to invest these premiums, collecting a float premium. Of course they are limited in how much risk they can take with the money they are holding to pay out any possible claims. Regulators generally require them to put a certain amount in a “risk free “ asset like government debt, and the rest in riskier assets. If government debt is negative yielding, we again get to a destructive feedback loop that has major second order impacts.

From the Gavekal note:

The insurance company could raise its premium by the amount of the expected loss from holding the bond (not very commercial), or it could just underwrite less business. Either way, it will have less money to invest in equities and real estate. Simply put, either the insurance company’s clients will pay the negative rates, or the company itself will do so by increasing its risks without raising returns. This means that either the client pays more for insurance, and so becomes less profitable, or the insurance company takes a hit to its bottom line.

People will have to pay more premiums for less insurance coverage.

Long term, negative rates will exacerbate the retirement crisis and basically destroy the business models of banks and insurance companies as we know them. This doesn’t automatically mean negative interest rates can’t persist. Perhaps there are other ways to provide for old people (ie higher taxes on a shrinking economy?) Banks and insurance companies can find other ways to make money. Regulators might respond, by changing rules or creating various incentive programs.

In this post I only covered only a few of the second order impacts of negative interest rates. Negative interest rates make the capital asset pricing model give nonsensical infinite results. I think CAPM is mostly bullshit anyways, but enough people use it that it has a reflexive impact on asset pricing. Unwinding it won’t be easy. I didn’t even touch on how negative rates can screw up the plumbing of financial markets: repo markets, securities settlement , escrow etc. Not enough people have really thought this all through. Many of the assumptions that have historically driven investor behavior will no longer hold if negative rates persist.

Maybe interest rates will normalize again. It will wipe out a few of the most overleveraged players, but the financial system will recover quickly. On the other hand, if negative rate do persist, get ready for a slew of unintended consequences in places you didn’t expect.

See also:

Mysterious by Howard Marks at Oaktree

Empty Spaces on Maps

Prior to the 15th century, maps generally contained no empty spaces. Mapmakers simply left out unfamiliar areas, or filled them with imaginary monsters and wonders. This practice changed in Europe as the great age of exploration began. In Sapiens, Yuval Harari argues that leaving empty spaces on maps reflected a more scientific mindset, and was a key reason that Europeans were able to conquer and colonize other continents, in spite of starting with a technological and military disadvantage. Conquerors were curious, but the conquered were uninterested in the unknown. Amerigo Vespucci, after whom our home continent was named, was a strong advocate of leaving unknown spaces on maps blank. Explorers used these maps to move beyond the known, sailing into those empty spaces so they did not stay unmapped for long.

The same phenomenon occurs in business. In the Innovator’s Dilemma, Clayton Christensen shows why large established ostensibly well-run companies so frequently miss out on major waves of innovation. A key principle in the book is the difference between sustaining technologies, which merely improve the status quo, and disruptive technologies, which offer a new and unique value proposition. Large companies will frequently focus on sustaining technologies, and ignore disruptive technologies that serve fringe markets initially. Ultimately its disruptive technologies that define business history. Yet complacent companies don’t figure that out until its too late.

Companies whose investment processes demand quantification of market sizes and financial returns before they can enter a market get paralyzed or make serious mistakes when faced with disruptive technologies.

There are two parts to overcoming the innovator’s dilemma:

- Acknowledging that the market sizes and potential financial returns of a nascent market are unknowable and cannot be quantified (drawing the blank spaces on the maps) and;

- Entering the nascent market in the absence of quantifiable data- (travelling into the empty space)

Analogous ideas also apply to investing. In Investing in the Unknown and Unknowable, Richard Zeckhauser distinguishes between situations where the probability of future states is known, and when it is not. The former is the realm of academic finance and decision theory. The latter is the real world.

The real world of investing often ratchets the level of non-knowledge into still another dimension, where even the identity and nature of possible future states are not known. This is the world of ignorance. In it, there is no way that one can sensibly assign probabilities to the unknown states of the world. Just as traditional finance theory hits the wall when it encounters uncertainty, modern decision theory hits the wall when addressing the world of ignorance.

Human bias leads us into classic decision traps when confronted with the unknown and unknowable. Overconfidence and recollection bias are especially pernicious. Yet just because we are ignorant doesn’t mean we need to be nihilists. The essay has some key optimistic conclusions:

The first positive conclusion is that unknowable situations have been and will be associated with remarkably powerful investment returns. The second positive conclusion is that there are systematic ways to think about unknowable situations. If these ways are followed, they can provide a path to extraordinary expected investment returns. To be sure, some substantial losses are inevitable, and some will be blameworthy after the fact. But the net expected results, even after allowing for risk aversion, will be strongly positive.

Examples in the essay include David Ricardo buying British Sovereign bonds on the eve Battle of Waterloo, venture capital, frontier markets with high political risk, and some of Warren Buffet’s more non-standard insurance deals. Yet since even the industries that seem simple and steady can be disrupted, its critical to keep these ideas in mind at all times in order to avoid value traps.

The best returns are available to those willing to acknowledge ignorance, then systematically venture into blank spaces on maps and in markets.

Investing in the Unknown and Unknowable

See also:

When is the crowd right?

Humans have flawed brains that cause them to act crazy sometimes. And in groups, people get even more crazy. Many smart people believe dumb things. Sometimes a group of otherwise completely sane people come together and do something insane. History is full of examples of the “ Extraordinary Popular Delusions and the Madness of Crowds, or Manias, Panics and Financial crisis. Humans sometimes join suicide cults. Human literally burned witches not that long ago. Groupthink is a helluva drug.

Financial markets provide an arena in which the biggest gains can be made betting against consensus. Yet statistically speaking, the consensus is usually right. The times when the crowd goes crazy are notable because they are exceptions. One must carefully decide when to be a contrarian.

Under what conditions is the consensus likely to be wrong? Lets invert the question: under what conditions is the crowd likely to be right?

Most of the time, a large group of people actually comes to a more accurate conclusion than any one individual. The success of Estimize, which crowdsources earnings estimates is one useful empirical example. “Wisdom of Crowds” is a well documented phenomenon, and well summarized in the book by the same title.

Why is the crowd so often right? What must happen for the crowd to be right ? Researchers have identified four interrelated conditions that encourage the wisdom of the crowds:Diversity, Information Availability, Decentralization, and existence of an Aggregation Mechanism.

Understanding these conditions can help one know when to follow the zeitgeist, and when to make a contrarian bet against it. A firm grasp of the facts on both sides of a controversy is necessary, but possibly not sufficient. One can never be sure of all the facts. Its also useful to understand the broader social forces, and how they influence the likelihood of the consensus being right or wrong. Searching for these conditions(or their absence), can be a useful method of avoiding cults and identifying opportunity, beyond just the facts of the individual situations.

The biggest gains are available by being a contrarian who understands the crowd.

The key is understanding when the wisdom of crowds flips to the madness of crowds. And the essential insight is that it has to do with a violation of one or more of the core conditions for a wise crowd.

Michael Mauboussin: Who is on the other side?

Diversity

Diversity implies that each person has their own point of view and some private information, even if only their unique interpretation of the available public information. Diversity is important because it adds different perspectives and increases the amount of available information.

The Value of Crowdsourcing: Evidence from Earnings Forecasts

Crowded trades have a tendency to crash- leading to no bid markets all the way down. Academics have noted that in a run up to a market crash diversity of population declines. The market becomes fragile, and eventually there is no one to buy from (or sell to).

One reason Estimize’ earnings estimates have tended to be better than Wall Street Sell side is that Estimize analysts are a diverse group of independent thinkers from around the world, holding a variety of different jobs. A lot of Wall Street analysts go to the same conferences, went to the same schools, etc.

When people come to the same conclusion from different backgrounds, logical methods, etc , their collective wisdom refines understanding of reality. The opposite occurs when people feel pressure to conform. Its important to note this is a genuine deep diversity of thought and perspective, not a superficial check the box diversity.

If multiple people with different viewpoints all come to similar conclusions, the odds of the opposite being true decrease substantially. On the other hand, if there is an obivous archetype of the thinker on the other side, then maybe a contrarian opportunity is available.

As Michael Maubossin has noted- conformity is a nonlinear process:

Scientists even have a sense of the neurobiological basis for conformity.Informational cascades occur when individuals follow the decisions of those who precede them without regard to their personal information.

Epidemiological models are useful here.

Information

The wisdom of crowds does not emerge in groups of idiots. It only applies when there is widespread access to information necessary to reach a conclusion. The extreme opposite occurs in totalitarian societies (or large corporations), where information is tightly restricted. Prior to the internet, information sometimes diffused slowly through a market, leading to massive price discrepancies obvious at even a quick quantitative glance.

Quality of input is critical to the success of crowdsource analysis:

Alternatively, it is possible that the inclusion of forecasts from certain individuals, such as Non-Professionals, may provide no value, or worse, cause the Estimize consensus to deviate further from actuals. Surowiecki (2004) states that although diversity matters, assembling a group of diverse but thoroughly uninformed people is not likely to lead to wise outcomes.

Independence

Independence is related to diversity. People need to be able to freely analyze reality and discuss opinions. Conventional wisdom is more likely to be accurate when it is freely subjected to challenge. When there are institutional or social factors that make people extremely afraid to speak truth, what everybody says to be true, may be wrong.

Children learn of this phenomenon early through the Emperor Wears No Clothes. For grown ups, see Death of Stalin for an example of lack of independence leading to morbidly hilarious results.

Independence requires relative freedom from opinions and actions of others, not complete isolation. Independence enables people to actually express their diverse information and reduces potential bias in the group decision.

Decentralization

Decentralization allows people to specialize and draw on local knowledge, without any individual or small group dictating the process.

Diversity and independence all fit in nicely with decentralization. Through specialization, decentralization encourages independence and increases the scope and diversity of information. Decentralization reduces the risk that independence and diversity will go away. Similarly having capital flows from all around the world, not just from a small group of schools or similarly thinking firms, increases the likelihood that markets become more efficient.

Existence of an Aggregation Mechanism

Finally, an aggregation mechanism is necessary to collect the individual opinions and harness the ‘wisdom-of-crowds’ effect.

This is basically why capitalism has succeeded. The price mechanism aggregates facts about supply and demand better than any bureaucracy could. At the same time, this why often the best opportunities to earn an investment profit are in illiquid asset classes where the market does not function as an aggregation mechanism to make the price close to right.

Of course, just because the market consensus is wrong, doesn’t mean that is necessarily wise to bet against it today. Must also consider reflexivity, narratives, and capital flows etc, and maintain a balance sheet that allows one to survive long periods of mass delusion.

Postscript: This is all indirectly related earlier post on finding underfollowed opportunities: The hard thing about finding easy things . This linked the ideas of both Sun Tzu and Warren Buffett. Some of the specific opportunity sets mentioned in this post have since been too widely known and we’ve moved further into more esoteric off the beaten path ideas. Nonetheless the basic principal still holds: there are more likely to be opportunities where the crowd isn’t looking.

A Different Kind of Death Spiral: ETFS, Mutual Funds and Systemic Risk

The rapid growth of ETFs is one of the most significant changes to financial markets in the last decade. Total ETF AUM grew from $0.5 trillion in 2008 to over $3 trillion by the end of 2017. More remarkably, AUM of ETFs invested in illiquid sectors such as global bank loan , emerging market bonds, and global high yield bonds increased 14 fold from $10 billion 2007 to $140 billion at the end of 2017. Prior to the last financial crisis, ETFs were a relatively small niche, but these past few years it seems like every asset manager has launched an ETF. Most investors have a large portion of their retirement assets in ETFs, and many investors exclusively invest in ETFs.

This is a major systemic change from what was in place prior to the last financial crisis. Since markets go through cycles its worth asking: how will the ETF ecosystem hold up next time there is market turmoil?

ETFs have overall been a massive benefit to investors because they lowered costs. Yet as more and investors put more and more money into ETFs, there are growing signs of distortions. Some investors have pointed out how ETFs are creating bizarre valuations that are unlikely to be sustainable. Additionally, there are growing signs that the ETF structure is far more fragile than most market participants realize. These aren’t just doom and gloom conspiracies from Zero Hedge. Organizations such as the IMF, DTCC, G20 Financial Stability Board, and the Congressional Research Service have all pointed out possible risks from the unintended consequences of ETF growth.

How the ETF ecosystem works

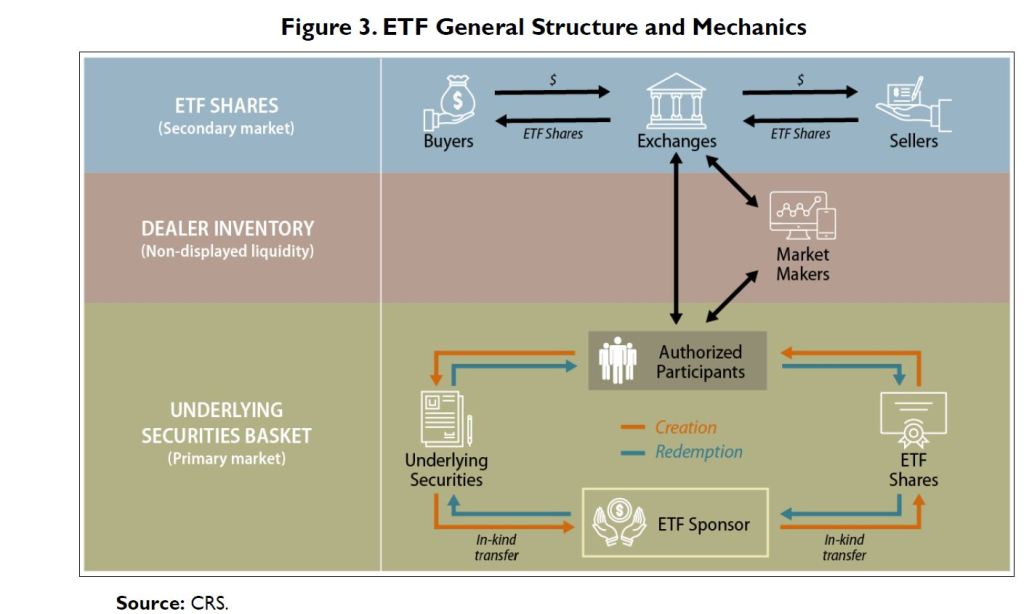

The structure and mechanics of ETFs are unique and different from mutual funds. Unlike mutual funds, ETFs generally don’t have to meet redemptions in cash. The key difference is the role of Authorized Participants (APs), and the arbitrage mechanism. The Congressional Research Service provides a handy diagram explaining the structure (Most fund sponsors have similar diagrams in their whitepapers) :

From the same CRS paper:

In a typical ETF creation process, the ETF sponsor would first publish a list of securities in an ETF share basket. The APs have the option to assemble and deliver the securities basket to the ETF sponsor. Once the sponsor receives the basket of securities, it would deliver new ETF shares to the AP. The AP could then sell the ETF shares on a stock exchange to all investors. The redemption process is in reverse, with the APs transferring ETF shares to sponsors and receiving securities.

ETF shares are created and redeemed by authorized participants in the primary market. The fund sponsors do not sell their ETF shares directly to investors; instead, they issue the shares to APs in large blocks called “creation units” that usually consist of 50,000 or more shares. The APs’ creation and redemption process often involves the purchase of the created units “in-kind” rather than in cash. This means that the shares are exchanged for a basket of securities instead of cash settlements.

The supply of ETF shares is flexible, meaning that the shares can be created or redeemed to offset changes in demand; however, only authorized participants can create or redeem ETF shares from the sponsors. A large ETF may have dozens of APs, whereas smaller ETFs could use fewer of them.

The “arbitrage mechanism” is a key feature of the ETF ecoystem. The market incentivizes APs to correct supply demand imbalances for ETFs because they can always exchange underlying shares for the securities in the portfolio and vice versa. So theoretically ETFs should not end up with discounts or premiums to NAVs like closed end funds.

Additionally, since the ETF Sponsor can redeem in kind, rather than in cash, they don’t need to sell underlying securities to meet redemption requests, like with mutual funds. Additionally, unlike with mutual funds, you get some intraday price transparency. Sometimes media commentary on “illiquid assets in liquid wrappers” mixes these up, but the nuance is important to how the respective ecosystems will react to market turmoil.

The arbitrage mechanism is a huge benefit for ETFs, and it works pretty well for deep liquid markets, like large cap stocks. Yet with less liquid assets such as leveraged loans or high yield bonds, there is reason to worry. ETFs haven’t really solved the liquidity mismatch problem. Closely related, any understanding of market history leads us to conclude that APs are unlikely to function in a falling market.

Liquidity mismatch in ETFs

Theoretically if there is a flood of selling at ETF level, APs can buy from portfolio managers, then exchange for underlying securities. However what happens if there is no bid/ask for some or all of the underlying securities?

There are several large ETFs that consist of leveraged loans and high yield bonds. A retail investor can have instant liquidity in the ETF market, and theoretically if there is an imbalance in the secondary market APs will step in and exchange ETF shares for the underlying bonds and loans. Yet these underlying assets can go days without actually trading(they are “trade by appointment”) . ETFs may be a small percentage of all outstanding bonds/loans, yet there is very little turnover of these assets, and often its difficult to get pricing. Its not clear how the market would respond if there was a macro event that caused loan prices to gap down, and investors to seek redemptions from ETFs en masse. Prior to the last financial crisis, few ETFs held high yield bonds, and no ETFs held leveraged loans.

According to the DTCC:

Some analysts assert that ETFs have become so large in certain markets that the underlying securities may no longer be sufficiently liquid to facilitate ETF creation/redemption activity during periods of stress and could result in price dislocations.

From Duke Law’s FinReg Blog:

Consider a crisis scenario where selling pressure causes underlying assets (like fixed income securities) to become illiquid and rapidly lose value prompting ETF holders to quickly sell their shares. Here market makers and APs would likely widen their bid-ask spreads to “compensate for market volatility and pricing errors.” Increased fund redemptions in the primary market could also detrimentally change the composition of the underlying portfolio basket causing APs – who no longer want to redeem ETF shares and receive, in-kind, the plummeting and illiquid securities – to withdraw from the market altogether.

Also notable, post financial crisis regulatory changes caused bond dealers to hold less inventory. This can mean less liquidity in a crisis, as this recent academic paper notes:

When an extreme crisis hits, historically, OTC market liquidity disappears. That is, no one is available to take the other side of the trade. There are simply no bids, no offers, and no trading activity in OTC markets. The recent reduction in dealer inventories means that markets will be even more volatile in the next crisis.

This is unlikely to be a problem for deep liquid markets such as large cap stocks. So any problem with popular stock index funds is likely to be resolve itself quickly But it could take a long time to unwind problems in leveraged loan and high yield bond ETFs.

Won’t the APs fix this?

Its important to emphasize that the APs have no fiduciary duty to provide liquidity. The AP will have an agreement with the fund sponsor, but the fund sponsor does not compensate the AP directly. APs can profit by acting as dealers in the secondary market, or clearing brokers, thus collecting payment for processing and creation/redemption of ETF shares from a wide variety of market participants. APs can stop providing liquidity anytime they want. In the event of a crisis it may be prudent to do so. From Duke Law:

As such, a reliance on discretionary liquidity, in the context of a crisis is inherently “fragile” since dealers and market makers will stop providing it once they start incurring losses, or their balance sheets are negatively impacted from other exposures and they can no longer bear the additional risk from providing the liquidity support

In 2013 some ETFs traded at a steep discount when Citigroup hit its internal risk limits. That was in the middle of a great bull market. What will happen if there is a serious macro problem? As a historical precedent, during the financial crisis the auction rate security market collapsed when discretionary liquidity providers exited due to turmoil.

A different kind of death spiral

There are risks for both ETFs and Mutual Funds that hold illiquid assets. However the reasons are different, and the nuances of a blow up will be different.

A mutual fund can get exemptive relief from the SEC to suspend cash redemptions in extreme circumstances. Mutual fund investors, who thought they had a daily liquidity vehicle, are left holding an illiquid asset. This happened to the Third Avenue Focused Credit fund a couple years back. This caused a short lived mini-panic in the high yield debt market. When the fund suspended cash redemptions, they paid redemptions in shares of a liquidating trust. An outside party offered to buy the shares at a 61% discount to the NAV, which had already declined sharply.

In the case of an ETF it’s a bit more complicated. The death spiral could simply take the form of a self reinforcing feedback loop. Retail investors would be able to exit, albeit at a steep discount. APs would sell underlying securities that they can sell, causing prices to plummet, causing further retail panic. Some assets are more illiquid than others, and once once the dust settles, the ETF will be left holding the most illiquid and opaque assets.

During the past few years we’ve seen a few tremors. There was the short incident in 2013 mentioned above. In May 2010 and August 2015 there were large one day price swings in more liquid parts of the ETF market probably caused by algorithms. In February 2018 there was the great VIX blowup/ “volmageddon”. The VIX example was a bit different because it involved very unique derivatives, but I think the bigger more interesting problems could be in the credit space. In 2018Q4 there was some volatility in the credit space, and MSCI noted ETFs appeared to have a mild impact on bid/ask spreads. Yet by historical standards what happened in 2018Q4 was very minor.

These examples all occurred during a long bull market. What will happen in the next 2008 type scenario? I Still need to look more into how they might actually unwind.

So what can an investor do?

Most ETFs(and mutual funds) will probably be fine. During a crisis there might be temporary NAV discounts even for large cap index funds and lots of panic selling all around. Mutual fund investors will redeem at the worst possible time, and funds will sell shares into a falling market to meet these requests. Headlines will be full of doom and gloom. The prudent thing for most investors will be to ignore it all. Continue dollar cost averaging across the decades to retirement and beyond.

Nonetheless, investors holding some of the more esoteric, illiquid ETFs and mutual funds could be in for an unpleasant surprise and possible permanent capital impairment. Even though these potentially problematic funds are a small portion of the overall market, there is likely to be systemic contagion, as the IMF noted.

I’ve purchased some cheap puts on more fragile ETFs(mainly high yield bond and leveraged loan) although the lack of an imminent catalyst means that the position size needs to be small. I’ll be looking more closely at the way these different types of structures are unwound, since there are likely to be some major time sensitive opportunities next time it occurs.

Other possible case studies of the unwinding of illiquid assets in liquid wrappers:

- UK open end commercial property funds during Brexit vote

- Auction rate securities during financial crisis

- Interval Funds during the financial crisis.

- Other mutual fund redemption suspensions and ETF tremors?

See also:

Some Recent Deep Reads- May 2019

Investing/Business

The Ruthless, Secretive and Sometimes Seedy World of Hedge Fund Private Investigations Highly entertaining expose.

Listening to Barakett talk about some of his wildest cases gives some idea of how easy it is for people to fall through the cracks during cursory due diligence. For example, on its website, DDC says it once found that “the president of a large U.S. asset manager was arrested twice for major art theft” but was never charged due to the expiration of the statute of limitations.

The art theft case was a “thing of beauty,” Barakett recalls. The manager, who still runs $2 billion, was even discovered to have one of the stolen paintings in his office when a police investigator went to interview him regarding the second theft. (The man was in college at the time of the thefts, which were from the university.) DDC’s client, a family office considering making a big investment, “could not believe what we were telling them,” Barakett says. It decided to walk away.

Another case involved a Bear Stearns executive whose murder conviction had previously gone undetected because, Barakett suspects, a casual background check either did not look at records in every state he had lived in or checked the wrong name or date of birth. “Our client [an asset manager who was considering hiring the man for an IR position] could not believe it, and we showed him the proof,” he recalls.

Vanguard Patented a Way to Avoid Taxes on Mutual Funds Interesting implications for tax policy, fund structuring and intellectual property strategy.

Vanguard has discussed licensing its hybrid ETF-mutual fund design to other firms, but no deal has come to fruition, according to people with knowledge of the talks. Those that have expressed interest included both index followers and active stock-pickers. United Services Automobile Association licensed the patent but never used it, and Van Eck Associates Corp. once sought regulatory approval for a similar design. Spokesmen for USAA and Van Eck declined to comment

Biglari Holdings is the Fyre Festival of Capitalism Hilarious because I’m not a shareholder in this company.

Many managements probably revile their shareholders, but most of them do not publicly delight in doing so. Sardar Biglari and Phil Cooley, Chairman and Vice Chairman of Biglari Holdings, seem to delight in the annoyance of its shareholders. At one point laughing at them for being upset that the share price went down 58% last year and then subsequently watching the board increase Sardar’s compensation package. It is not my best-self that enjoyed this spectacle, it was more like the part of me that likes watching dragons fight dragons on Game of Thrones that was riveted by Sardar Biglari and Phil Cooley or the part of me that once saw two clowns get into a fist fight at a kid’s party in St. Petersburg and rather enjoyed it.

Buspirone Shortage in Healthcaristan SSR Close look at weird incentives and unintended consequences of regulation in the generic drugs market.

You get more of what you subsidize and less of what you tax. Unfortunately, the FDA is inadvertently taxing companies for being in the generic drug business. And it’s taxing them more if they’re not a monopolist with economies of scale. That means we get fewer companies in the generics industry, and more monopolists.

So my very tentative guess as to why buspirone is more plagued by shortages than bread or chairs is because number one, the need for FDA approval makes it hard for new companies to enter the buspirone industry, and number two, the FDA’s fee structure favors large-scale monopolies over small-scale competitors.

Why So Many Investors Missed Nike’s Stock Rebound Good case study

Legendary stock-picker Peter Lynch’s maxim to “buy what you know” has long been misconstrued to mean invest in the everyday products you consume. That’s not quite right, as it only reflects part of his investment strategy. The other half is buying what you have a unique insight into that the market has yet to figure out. Knowing what those things are is the hard part.

Artko Capital 2019Q1 Letter Interesting commentary around position sizing.

This is where the “Valeant problem” that is rarely discussed, becomes an issue for us: what to do with a position that rapidly increases in size relative to the rest of the portfolio and where Hahn Capital Management and Sequoia/Value Act approaches to the matter differed. While the latter funds continued to hold, and allowed the single position to become almost a third of their portfolio, Hahn Capital had strict risk controls and processes in places that forced them to sell down the position to at least 4% of the portfolio when it became 6% of the portfolio’s weight. Luckily for Hahn, they exited the position prior to the spectacular blow up while the other aforementioned funds suffered significant double-digit portfolio losses when the truth about Valeant’s practices became public. Of course that is not to take away from the spectacular track records of all of the aforementioned funds, but to point out how different investment strategies (concentrated versus diversified), portfolio manager incentives (Management Fee Only versus Performance Carried Interest), and risk control processes (on single position sizes) can result in very different portfolio returns and risk profiles for different shareholders of the same stock. To put another way, sometimes a sell decision is not one of security analysis but one of portfolio risk management and fund strategies. As a result of this, and other similar experiences throughout our career, we have tried to approach the middle ground of the two styles by having a strong degree of concentration and conviction in our portfolio while still maintaining a robust portfolio risk management process focusing on capital preservation, position size, and its risk-reward ratio relative to the rest of the portfolio.Additionally, we believe the other lesson to be learned from Valeant was no matter how high of a conviction, knowledge base or confidence you have in a publicly traded company or its management, at the end of the day things can and occasionally do go unpredictably wrong and are out of your control. This is a staple of public equities investing and is a common mistake made by even the most reputable investors: having the illusion of control.

An Ancient Relationship: FinTech and Financial Advice Classic look at an ancient profession. Interesting how the stock ticker seemed to have an impact almost as large as the internet.

How has this profession lasted so long? The industry’s longevity is largely attributable to financial technology (FinTech), which has historically empowered advisers to better serve their clients. Many companies, for example, offer advisers quantitative and accurate measurement of investors’ risk tolerance. Equipped with this technology, advisers have a better sense of how clients will respond to volatility, and can construct portfolios that most accurately reflect a client’s ability to endure market swings.

The ticker technology served as a means for democratizing access to market information. Prior to its invention, only those physically present at the stock exchange – or very close by – were privy to real-time market prices. Everyone else received their data at a substantial lag, often to the point where it was no longer useful. Once the ticker was released, however, cables and telegraphs connected brokers across the country to a network of data constantly flowing from a central source, the New York Stock Exchange. According to Horace Hotchkiss, 23,000 offices paid for ticker services in the United States

In Defense of Complexity Most people are knee jerk advocates of simplicity, but forget what lies beneath.

But simple is impossible without complex. Simple is how you interact with your web browser or an app on your phone. Complex is everything else happening in the background that allows it to function.

There are some valuable and diversifying asset classes that routinely get discarded to the “Too Complex” pile for reasons related to ambiguous classification, unfamiliar tools, novel wrappers and peer/career risk. Which is unfortunate, because I would argue that certain alternative investments are complex in implementation only. Conceptually, they are often quite simple, intuitive, backed by data and grounded in economic theory. The arc of the investable universe is long, and it bends towards democratization and innovation. Not every shiny new toy deserves a spot in your portfolio, but it would be wise to reconsider exactly what constitutes simplicity in investing.

Geopolitics and History

You read in every textbook that cliché: Power corrupts. In my opinion, I’ve learned that power does not always corrupt. Power can cleanse. When you’re climbing to get power, you have to use whatever methods are necessary, and you have to conceal your aims. Because if people knew your aims, it might make them not want to give you power. Prime example: the southern senators who raised Lyndon Johnson up in the Senate. They did that because he had made them believe that he felt the same way they did about black people and segregation. But then when you get power, you can do what you want. So power reveals. Do I want people to know that? Yes.

….

There’s always something the other guy doesn’t want to tell you, and the longer the conversation goes, the easier it is to figure that out

The one thing we haven’t had mercifully over the last 60 year except for the breakdown of Yugoslavia, and Iraq and so on is a major confrontation between big powers wanting to escalate.

Philosophy/Psychology Etc

On the Collaboration Between psychiatrist Carl Jung, and Physicist Wolfgang Pauli

While there is a long and lamentable history of science — physics in particular — being hijacked for mystical and New Age ideologies, two things make Jung and Pauli’s collaboration notable. First, the analogies between physics and alchemical symbolism were drawn not only by a serious scientist, but by one who would soon receive the Nobel Prize in Physics. Second, the warping of science into pseudoscience and mysticism tends to happen when scientific principles are transposed onto nonscientific domains with a false direct equivalence. Pauli, by contrast, was deliberate in staying at the level of analogy — that is, of conceptual parallels furnishing metaphors for abstract thought that can advance ideas in each of the two disciplines, but with very different concrete application.

What If We Already Know How to Live?